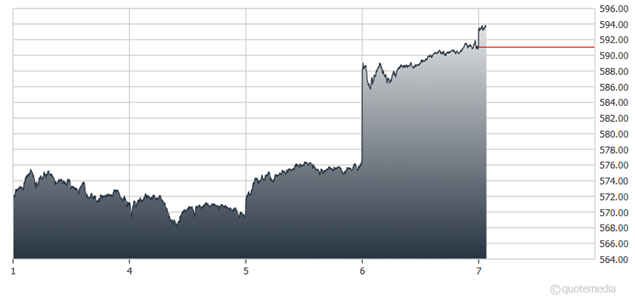

Many investors may have missed the post-election rally and will be looking to buy on the dips, as investors expect that a Trump policy agenda favoring lower taxes and less regulation may support corporate profits. The S&P 500 jumped 2.5% Wednesday, which was its best post-election day in history, advises Fawad Razaqzada, technical analyst at Trading Candles.

Some 86 names in the S&P 500 hit new all-time highs, making them among the top stock gainers post-election. The Nasdaq 100 hit a new record after rising 2.7% on the session. But there are a few issues that might come into focus now that the dust is settling down.

S&P 500 ETF Trust (SPY)

Markets were caught off guard by just how quickly the results arrived – not in days, as expected, but in mere hours. With the Senate promptly called for the Republicans, the initial market response began almost immediately in early Asian trading. The Trump Administration, widely regarded as pro-deregulation and keen on tax cuts, sent a clear message that it’s likely to support corporate profitability.

That said, much of the buying has likely already taken place before the election and now in the immediate aftermath. What is more, with the US election risks behind us and a surprisingly straightforward outcome, Trump’s policy agenda remains on hold until 2025 – potentially even late into that year. So, there is plenty of time for the market to focus on other factors driving the markets.

One thing to watch out for is concerns over tariffs, which might hurt sentiment in China and Europe. It could also weigh on sentiment on Wall Street. Another big issue that comes to mind for the markets – and Trump – is the Federal debt limit. This will be reinstated on Jan. 2.

With rising yields, government borrowing at this pace looks unsustainable. How Trump addresses this issue with his plans to borrow even more and cut taxes remains to be seen. Could it trigger a ratings downgrade? This is a big risk that could undermine equities despite all the hype.

Meanwhile, with tech earnings mostly out of the way, there will be even fewer catalysts to drive the markets higher. Investors will be questioning whether the AI hype will continue to power revenue growth for tech companies, or whether we will see a slowdown.