I recently explained why Coherent Corp. (COHR) is one of my favorite semiconductor stocks thanks to its exposure to optical transceivers. But today, I want to talk about Cisco Systems Inc. (CSCO), notes George Gilder, editor of Gilder’s Technology Report.

Coherent’s highest-margin products, high-speed optical transceivers (400 Gbps/ 800 Gbps, and soon 1.6 Tbps), are used to move data across hyperscale data centers. That’s a rapidly growing market, thanks to the data demands of AI.

According to the Information Network, the market for 800 Gbps transceivers, which was $2 billion in 2023, will hit $3 billion this year, $4 billion next year, and $5.2 billion in 2026. The market for all high-end transceivers — 800G, 1.6T, and 3.2T (expected in 2026), is expected to grow at a CAGR of more than 25% through 2028.

Cisco Systems Inc. (CSCO)

But as well as COHR is doing in optical transceivers, it is not the market leader. That honor is shared by Cisco (30%), Arista Networks Inc. (ANET) at 25%, and Broadcom Inc. (AVGO) at 20%. Broadcom is expensive, while Arista makes Broadcom look like a bargain.

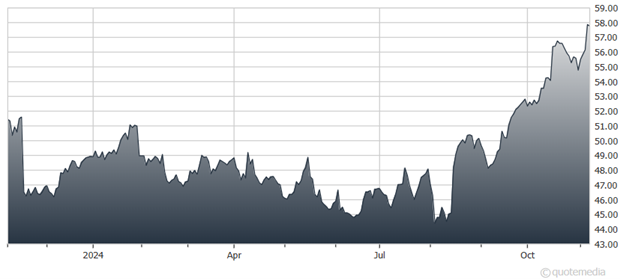

For Cisco, however, familiarity, not to mention boredom and flattish revenues, have long bred Mr. Market’s contempt. That venerable company now holds a price/sales ratio less than one fourth of Broadcom’s and closer to one fifth of Arista’s.

But Mr. Market has just begun to notice that CSCO is another AI play, giving the stock some momentum. Operating margins are healthy, though well short of Arista’s. Data movement is the core of AI.

Recommended Action: Buy CSCO.

Subscribe to Gilder’s Technology Report here...