The current book on my desk is about a sad-sack baseball franchise. Let me explain why I bring this up – and what it means for an attractive stock, Dorman Products Inc. (DORM), writes Tyler Crowe, author of Misfit Alpha.

For years, the franchise was the laughingstock of the MLB, and its owner was infamous for being a cheapskate. And yet, with some fresh faces in management and a new approach, it used novel analytics, player evaluation, scouting, and development to engineer one of the most remarkable turnarounds in baseball history.

You have probably assumed that I’m reading Michael Lewis’ Moneyball, but that isn’t right. I’m reading Jonah Keri’s The Extra 2%: How Wall Street Strategies Took a Major League Baseball Team from Worst to First. It profiles how a new ownership group turned the Tampa Bay Rays from the league's punching bag into the 2008 American League Champions.

Ever since the season Moneyball was based upon, the Oakland Athletics haven’t made it out of the first round of the playoffs. By contrast, the Rays went from a team the league considered dissolving to two World Series appearances.

What I find fascinating is if we were presented with the choice of reading “how a cheap baseball team tried some innovative ideas and got a few playoff appearances out of it” and “a cheap baseball team tried some innovative ideas and went to two World Series as a result of its actions,” I think we would all choose the latter.

And yet the world decided that Moneyball was the go-to tome of an underdog team defying the odds to tackle the Goliaths of the MLB. The difference? With all due respect to Jonah, Michael Lewis was a more established author and writes better prose. Lewis’ book was also a few years earlier.

This phenomenon is prevalent in investing and investment writing. All too often, who sends the message, how it is crafted, or when it is delivered is far more important than the message itself. Being able to separate the message from the source is a critical skill for all investors to hone over time.

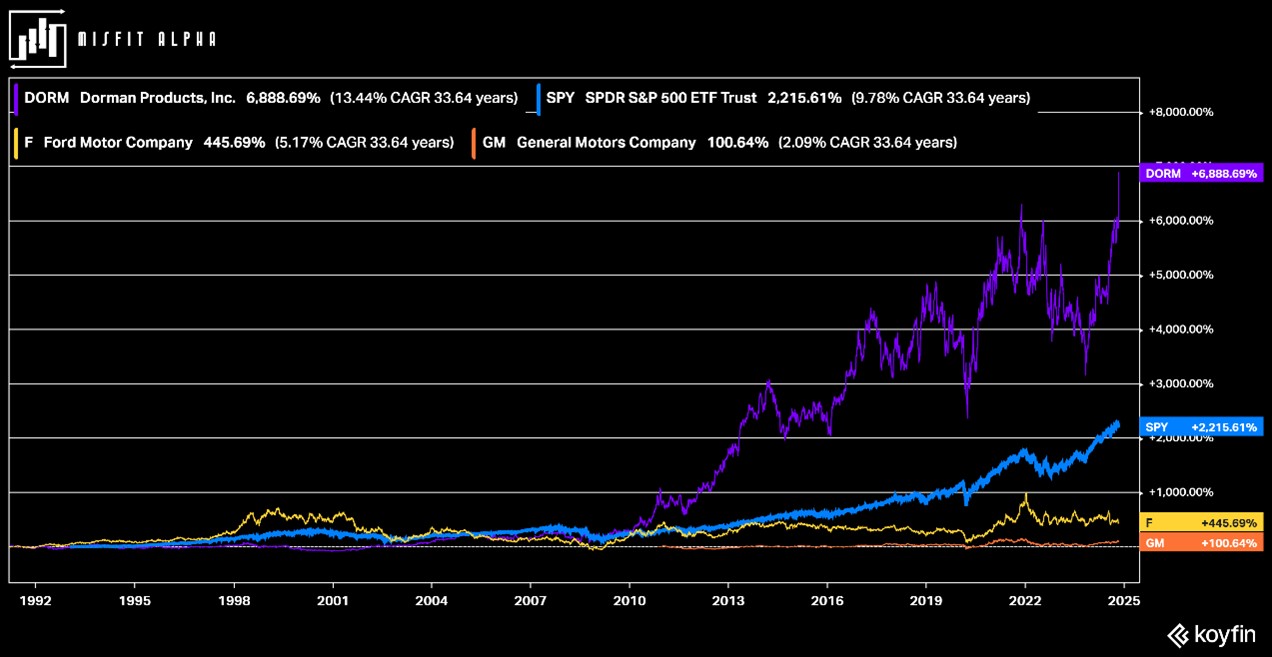

Let’s use DORM as an example. By any measure of investing, Dorman has outperformed Ford Motor Co. (F) or General Motors Co. (GM) on a total return basis over one-year, three-year, five-year, ten-year, 20-year, or longer time horizons. I can’t think of a world where an individual investor would have been better off investing in Ford or General Motors instead of Dorman.

Despite Dorman being a better investment for decades, it lives in relative obscurity. You could easily argue that aftermarket auto parts should be in the same industry as Ford and GM, but only four analysts have stock ratings with price targets compared to the 25+ that cover Big Auto.

In a world where clicks are more important than alpha, content creators are much more incentivized to craft a narrative around why Ford or GM are great investment ideas. For investors and consumers of financial media, determining between what is for clicks and what is helpful advice goes back to honing one’s ability to filter out the signal from the noise.

Often, the best investments one can make for long-term wealth building don’t have as compelling a narrative behind them. After all, we would all much rather own a Tampa Bay Rays-type investment rather than one closer to the Oakland Athletics.

Recommended Action: Buy DORM.