In a remarkable political feat, former President Donald Trump is now once again President-elect Donald Trump. Trump has now become only the second president to win two non-consecutive terms (the other was Grover Cleveland). So, what is my favorite market segment given the election outcome? Cryptocurrencies, explains Jim Woods, editor of The Deep Woods.

I know many of my readers (likely most) are overjoyed at the election result. I also know that many are disappointed. I know this, because so many have texted and emailed me expressing jubilance, while so many others have vented their anguish. It goes to show that my readers hold a variety of opinions, and that they take their convictions seriously.

(Editor’s Note: Jim Woods is speaking at the 2025 MoneyShow Las Vegas, which runs Feb. 17-19. Click HERE to register)

As far as markets are concerned, well, the feeling is unequivocally in the jubilance camp. Stocks roared to new, all-time highs “the morning after,” with several notable election winners surging in anticipation of a return to Trump’s policies, which are seen as pro-growth, anti-regulation, and anti-tax.

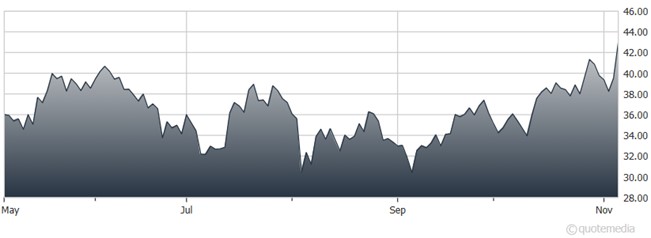

iShares Bitcoin Trust (IBIT)

Certainly, stocks are likely to continue to do very well. And as it is regardless of politics, stocks with the strongest earnings growth, strongest share price performance, most bullish technical patterns, and the most-bullish “NewsQ,” as I call it, will lead the way. I also think that despite a post-election selloff, gold is likely to continue doing well. Its store-of-value status, and its proven resilience as a must-have form of “wealth insurance,” holds true regardless of politics.

However, I think my biggest election winner is crypto. Trump is very pro-cryptocurrency, embracing the asset class while heavily courting the crypto community. I think this is a great thing, because crypto is an unstoppable force driven by demand and technology that cannot be denied or ignored.

Try as they may, and certainly SEC Chairman Gary Gensler has done just that, Bitcoin, Ethereum, Solana, etc., haven’t been stopped, because smart investors know this is the next big asset class for capturing alpha. For example, in November 2020, when Biden was elected, Bitcoin traded at $13,677. Today, four years and another administration-elect later, it trades at nearly $75,000. That’s a massive gain of nearly 450%!

I suspect that no matter how well your stock portfolio or your gold or silver holdings performed, they didn’t perform that well over the past four years.

Yes, that ride has been volatile. And yes, it’s not for all of your money. Yet for those who want to be on the right side of investing history, I think you need to embrace cryptocurrencies, and you need to do so now, as President Trump will almost certainly be an advocate.