I have learned a lot about how many traders approach the market over the years. More importantly, I have learned what most of them do wrong, as the mistakes made by most seem to be quite universal and ubiquitous. Let’s discuss three of the pitfalls into which traders fall – and how to avoid them, writes Avi Gilburt, founder of ElliottWaveTrader.

First, too many investors and traders will buy into a concocted narrative about the market or a stock despite the lack of empirical evidence regarding its truth or falsehood. Moreover, it rarely makes any difference if it is one that contradicts a narrative they told themselves the prior day.

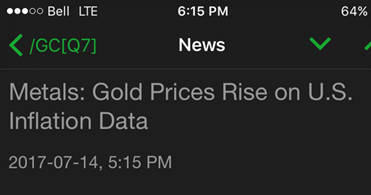

Consider how often you will see the market react in opposite ways seemingly to the exact same information being published on two consecutive days from two different economic sources. Here is a great example I have used many times before regarding gold:

As you can see, we had two news events suggesting the same thing about inflation (a decline might not last) within a day of each other. Yet gold moved in exactly opposite directions seemingly based upon the same news.

As Daniel Crosby noted in his book The Behavioral Investor: “Storytelling bypasses many of the critical filters we apply to other forms of information gathering...For this reason, stories are the enemy of the behavioral investor.”

Second, I have always said that “hope” is the most dangerous four-letter word in the English language for an investor or trader. I have seen this thousands of times in my career and it is one of the worst habits that investors display.

An investor will buy into a position (usually based upon some narrative), and continue to ride that position lower and lower while they “hope” they are right and that the price will turn. And, by the time the fundamentals or narrative have shifted to the point the investor finally realizes they were wrong, they often find themselves down 10% or a lot more.

For this reason, I have advised the thousands of investors and traders we have taught through the years that you must have an objective plan in place before you enter the trade or investment. You must know where your ideal entry is, where you intend to take profits, and where you exit with a small loss because you are wrong in your assessment.

Finally, one of the other problems that I often see is a lack of self-awareness as to the time frame that best suits a trader’s personality. You see, the personality of a day trader is very different from that of a swing trader and very different from that of an investor. Understanding which time frame best suits your personality and skill set is absolutely necessary for success at your endeavor.