Gold was smashed last Thursday, dropping more than $50 an ounce at one point during the trading session. Since then, the price has traded mostly sideways. But Thursday’s big sell-off wasn’t anything out of the ordinary. What’s really remarkable is how regularly they have come...and how the rebounds have been just as consistent, observes Brien Lundin, executive editor of Gold Newsletter.

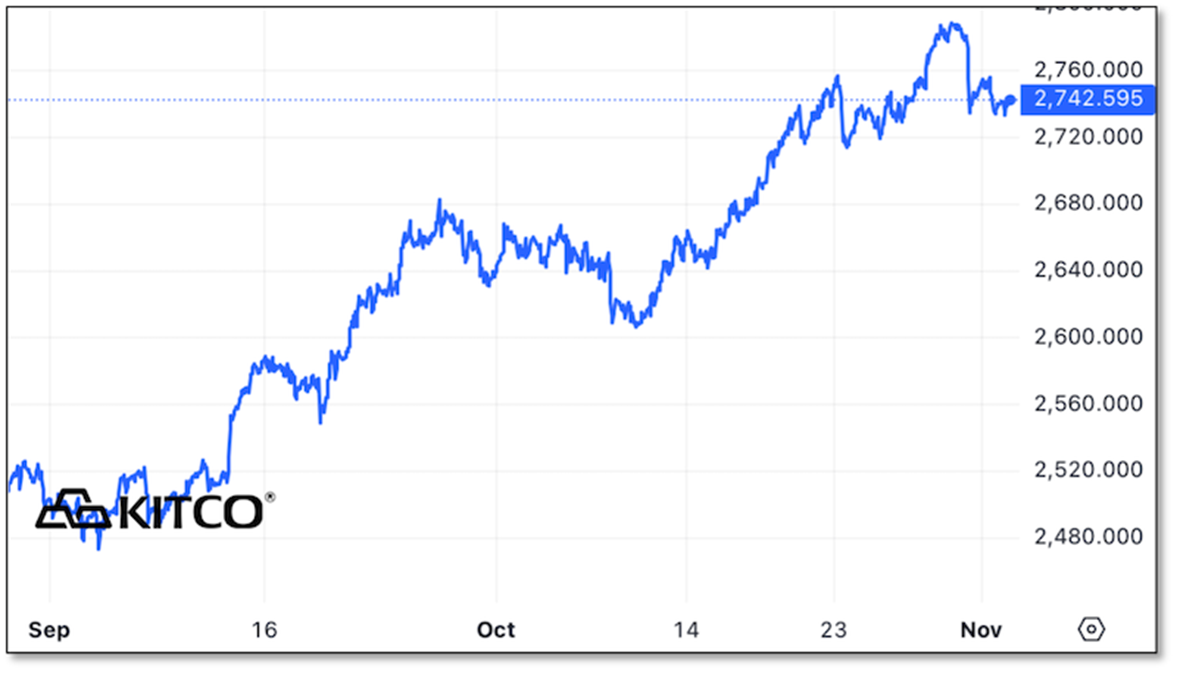

The three-month chart below places Thursday's correction into perspective:

The key to understanding things is an important discovery I made in mid-summer: Not only how remarkably consistent gold’s ebbs and flows have been, but also how accurately the width of its Bollinger bands has indicated the next move upward.

Bollinger bands are a measure of volatility. Generally speaking, a narrowing of the bands often presages a price breakout, usually in the direction of the previous trend.

If you’ve been following my analyses since early July, you know how I’ve used the bottoms in gold’s Bollinger bands to predict the beginnings of each new price rally. You’ve also become familiar with my chart showing each bottom in the band width.

This indicator predicted an imminent pause in gold’s big rally, as I noted in the November issue of Gold Newsletter issued just last week. That pause began with the big price decline on Thursday, just as we were putting the final touches on that issue.

Now, it seems like the next rally will begin...well, right around the time of the New Orleans Conference on Nov. 20. Which brings me to my next big point: I’ve been referring to the current situation in metals and miners as a generational opportunity. We haven’t seen anything like it since the turn of this century.

And while fortunes were created in the gold bull market that ran from 2000-2011, especially by those who invested in junior mining shares, this opportunity is much better.

Consider that back then, the metals and the mining shares were completely bombed out. Gold bottomed at $252 an ounce, while silver couldn’t get over $5. It took a lot of courage and confidence to bet that the metals were heading higher, much less to record levels.

Today, we have the luxury of gold often setting new price records day after day...while the mining stocks have yet to truly respond, with many still hovering near long-term lows. It doesn’t take a genius to see this opportunity; it only requires a lick of common sense.

We have been handed the kind of situation that we wouldn’t have dared wish for even a year ago. But this remarkable window of opportunity is beginning to close, as the price charts for quality junior mining stocks are just beginning to turn upward.

There’s still plenty of room to go, but the greatest gains are to be had by those acting now.