Since 1960, stocks have shown positive annual performances almost 75% of the time. The average annual gain is 11%, with a standard deviation of 17%. By these numbers, 2024 is a good-but-not-yet exceptional year. Meanwhile, we have raised our rating on Baker Hughes Co. (BKR) to “Buy,” advises John Eade, president of Argus Research.

The S&P 500 was recently up 23% year to date. The strongest return of any one year was the 37% advance in 1995. On the flip side, 2008 during the Great Recession was the lowest-performing year in which the S&P 500 fell 37%.

By deciles, annual returns most often fall in the 10%-20% range. This has occurred 16 times. In second place, perhaps surprisingly, is returns in the 20%-30% range. This has occurred 13 times, including in 2023.

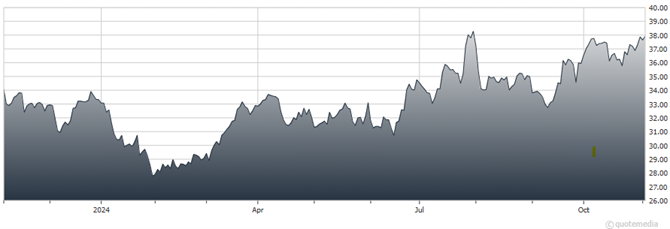

Baker Hughes Co. (BKR)

What does this say for 2025? Well, returns aren’t exactly random, and patterns do emerge. There have been eight instances since 1960 in which the stock market has risen at least three years in a row, including long runs of eight years in the 1980s, nine years in the 1990s, and eight years from 2009-2017.

Thus the historical trends seem to back another positive year for equities next year. What’s more important, of course, will be the fundamentals. Given our outlook for economic growth next year, declining interest rates, and positive corporate profit growth, we think the current bull market, now in its second year, has more room to run.

As for BKR, it has gone through several rounds of restructuring over the past few years (divesting non-core assets and reducing the overall company cost structure) and simplifying its organization (starting in September 2022). It is now gradually beginning to experience an uplift in its profitability as it works toward meeting customer needs and producing solutions in the rapidly evolving energy and industrial markets.

More to the point, the oilfield services and equipment business continues to show both improving top- and bottom-line growth. We predict international and offshore energy markets will remain strong through the end of 2024 and 2025, based primarily on continued global upstream capex spending. Our target price is $43.

Recommended Action: Buy BKR.