Farmers & Merchants Bancorp (FMCB) is a small community bank with 32 locations in California. F&M is a traditional bank, with the business focusing on taking in deposits and lending them profitably. It was founded in 1916, generates about $225 million in annual revenue, and had a recent market cap of $677 million, highlights Ben Reynolds, editor of Sure Dividend.

The company has paid dividends to shareholders for 89 consecutive years and has raised its dividend for 59 years. Given that longevity, the company is a part of the elite Dividend Kings club.

In mid-October, F&M Bank reported its Q3 results for fiscal 2024. Its adjusted earnings per share grew by 2.5% year-over-year to $29.96. The bank achieved 4% loan growth, with deposits remaining flat. Net interest income declined by 3%, as the net interest margin contracted from 4.17% to 4.07% due to higher deposit costs.

Management remains optimistic, highlighting F&M Bank’s strong net interest margin, which is one of the widest in the sector. We reiterate that F&M Bank has proven its resilience during downturns, such as the pandemic, potential recessions, and recent financial turmoil, including the collapses of Silicon Valley Bank, Credit Suisse, and First Republic.

We also see the bank having the potential for 5% growth moving forward, which we see accruing from higher loan balances, but also from a relatively new branch in Oakland. That estimate is likely on the conservative side, as F&M has more than tripled EPS from 2017 through 2023.

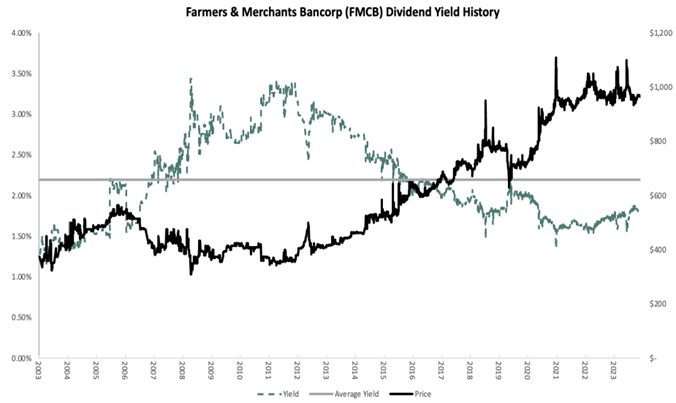

Share repurchases aid in the company’s growth. The company’s share count declined by 5.8% from 2020 through 2023. We estimate total annual return potential at 15.3%, which is attributable to the 5% growth rate, the current 1.8% dividend yield, and a valuation tailwind of 8.6%.

Recommended Action: Buy FMCB.