The US stock market continues to seemingly ignore domestic and international risks. That’s one reason I have suggested for years not to base your investments on page one in any newspaper, says Jordan Kimmel, founder of MagnetInvesting Insights.

“If I had eight hours to chop down a tree,

I’d spend six hours sharpening my ax.”

- Abraham Lincoln

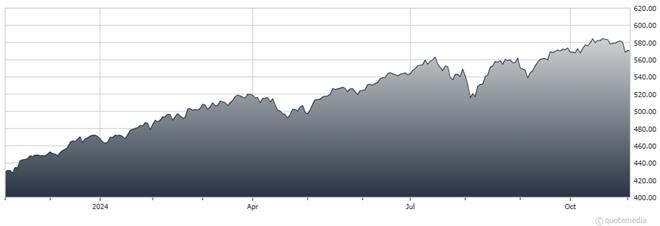

As I write this note, the war in the Middle East has been going on for over a year and the war in Europe has been going on for over two years. The tragedies of war are seen every day, and the domestic turmoil and the unrest domestically is difficult to endure. Somehow, despite all this, and the ballooning US federal budget deficits that continue to expand beyond any sense, the stock market has continued to act bullishly.

S&P 500 ETF Trust (SPY)

While I previously reminded investors of the traditional strength of markets leading into a Presidential election, even I am surprised at the resilience in the face of current events around the world. It has not been easy to be an investor these days.

Even with the current good health of the market, this environment has made it difficult for most investors to stay the course. Many traders have been whipsawed as computer algorithms are playing a bigger role these days. Trends seem to be stronger but not last as long. Investing is not easy, ever.

For now:

- The Advance/Decline line on the NYSE looks great, while the NASDAQ is still struggling. The 52-week new-high/new-low numbers on both look even better.

- It is “Fall clean up” time. Sell your lagging and sagging companies. Only strong and healthy companies belong in your portfolio.

- If you are bearish here, you are just predisposed.