You may have already heard, but there’s a presidential election this week. Leaving the politics aside, I want to take a look at how the financial markets might react to this. The 2024 election could end up being the closest one since Bush/Gore in 2000. That has implications for short-term volatility and what sectors and themes could perform better in the longer-term, explains Michael Gayed, editor of The Lead-Lag Report.

If you look at the prediction markets and models, they’re all showing an incredibly close race with just a day to go. The betting markets are giving higher odds of winning to Trump, but the pollsters indicate that the election is a virtual coin flip. That creates the possibility of some whipsaw reactions once we know the final result.

(Editor’s Note: Michael Gayed is speaking at the 2025 MoneyShow Las Vegas, which runs Feb. 17-19. Click HERE to register)

In more typical election cycles, we have a fairly good idea of who’s likely to win and the markets usually front-run the outcome. We may not be experiencing that this time around, but we do see some positioning based on expected themes regardless.

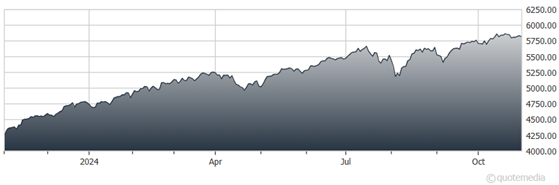

S&P 500

Meanwhile, if we look at history, the S&P 500 has a pretty good recent track record in the several quarters following presidential elections (Note: Returns are from Election Day through the end of the following year, or about 14 months).

2020 - S&P 500 +41%: Biden was favored to win in the lead-up to the election, but it took several days to get the final result. The S&P 500 moved higher by about 4%-5% in the week following the election and continued to rally with few interruptions. The returns here could be skewed somewhat because this coincided with a period of multi-trillion stimulus and 0% interest rates.

2016 - S&P 500 +25%: Never one to handle uncertainty particularly well, the equity futures market famously plunged overnight following the Trump victory because the markets gave it only a small likelihood of happening. Within just a day, the markets realized that Trump offered a pro-business platform built on tax cuts and other incentives. Just like in 2020, the S&P 500 rose steadily for more than a year post-election.

2012 - S&P 500 +29%: Obama was leading Romney in the polling just before Election Day, but the outcome was still in question. The S&P 500 fell by about 5% in the two weeks following the election, but it reversed course fairly quickly and, again, rose steadily with few interruptions.

The elections before that get a little hairier to interpret because they were heavily influenced by the tech bubble and the financial crisis.

Can we get another big double-digit rally in 2024/2025? I wouldn’t go as far to say that it’s likely, but it’s certainly possible. The S&P 500 is already up 37% over just the past year and trades at around 23 times the next 12 month’s earnings, so it’s not exactly starting from a place of value.

No matter who wins, expect some fireworks over the next week!