Capital One Financial Corp. (COF) is a diversified bank that provides banking services to consumers and businesses, as well as auto loans. But it is probably best known for its credit cards. If you watch any television, you’re probably familiar with its “What’s in your wallet?” tagline, notes Chris Preston, editor of Cabot Value Investor.

It’s the fourth-largest credit card company in the US, with $272.6 billion in purchase volume in the first half of 2023 alone. And it’s on the cusp of getting even bigger: Capital One is in the process of acquiring fellow credit card giant Discover Financial Services (DFS) for $35 billion. If approved, the deal could be completed either later this year or early next year and would make Capital One the largest credit card issuer in the US and the sixth-largest US bank by assets.

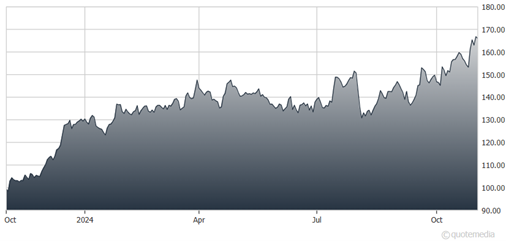

Capital One Financial Corp. (COF)

Even absent the Discover buyout, Capital One is growing just fine on its own. Its revenues have expanded from $28.5 billion in 2020 to $36.8 billion in 2023. This year, they’re expected to swell another 5%, to $39.1 billion, with another 6% uptick estimated in 2025.

And yet the stock is cheap, trading at 10.6x forward earnings estimates and 1.63x sales. The share price peaked at $177 a little over three years ago, in August 2021. It currently trades around $167.

The bank has caught Warren Buffett’s attention. In May 2023, Berkshire Hathaway disclosed that it had taken out a nearly $1 billion stake in Capital One. With earnings per share expected to rise more than 25% by the end of 2025, and with Discover Financial possibly adding an even greater windfall should the deal gain approval, it’s easy to see why the Oracle of Omaha likes it.

Capital One reported another strong quarter last Thursday, and the stock is up nearly 8% since! Revenue improved 6.4% year-over-year and narrowly topped estimates. While earnings per share declined slightly from a year ago, they easily (by 17%) beat estimates.

Recommended Action: Buy COF.