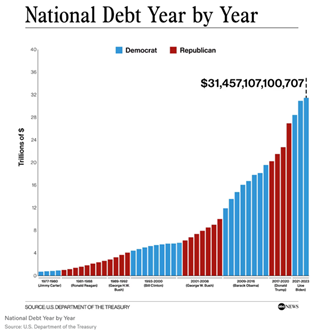

Donald Trump and Kamala Harris have distinctly different ideas on how to run the United States. But I can almost guarantee you that no matter which of them prevails on Nov. 5, our national debt will continue rising. That’s why the SPDR Gold Shares ETF (GLD) is worth buying, observes Nilus Mattive, editor at Weiss Ratings Daily.

After all, debt rose every single year under Donald Trump. It has continued to rise every single year under the Biden-Harris Administration. And indeed, other than a brief period of moderation between 1998 and 2001, it has risen every single year for as long as I’ve been alive.

This is why there are actually some tremors in the Treasury market itself right now. However, I think the bigger tell is the recent action in gold, which is the oldest and most established antidote to rampant money-printing, inflation, and reckless government spending.

Not a lot of pundits are talking about it, but gold has been having an absolutely stellar year — rising a staggering 31% versus a 22% increase in the S&P 500. That’s nearly 50% better performance from the yellow metal in a year that stocks are performing twice as well as usual.

Again, this is because more and more investors are waking up to the fact that cash is rapidly becoming trash. And as I said a moment ago, I don’t expect that to change no matter who wins on Nov. 5.

The reality is that our national debt has become a giant snowball rolling down a hill…growing larger with every new annual deficit...compounded by larger and larger amounts of interest. Can Washington keep things somewhat manageable with enough economic growth…lower interest rates…higher taxes…a return to fiscal sanity…or some combination thereof?

Yes. However, that’s the BEST-CASE scenario — a continued erosion of the dollar’s purchasing power over time rather than a complete US government debt collapse!

Therefore, it makes sense to own some gold and gold-related investments no matter who ends up in the White House. Not only can gold continue to rise along with America’s debts, but it also provides a terrific hedge against other risks, too.

So, if you don’t have exposure to gold, GLD is a great way to do it. I like other forms and related investments as well — everything from physical gold to certain mining companies.

Recommended Action: Buy GLD.

Subscribe to Weiss Ratings Daily here...