Although our (stock market) forces executed a strategic withdrawal across all fronts last week, our supply lines demonstrated remarkable resilience. The tenacity of our supply chain in the face of adversity suggests potential depth for counter-offenses, highlights Buff Dormeier, chief technical analyst at Kingsview Partners.

The theater of operations experienced a reverse echelon retreat, with the infantry units, iShares Russell 2000 ETF (IWM), suffering the heaviest casualties, falling back 3.03%, while the high command, Invesco QQQ Trust (QQQ), held its ground with minimal losses, retreating only 0.02%. Our reconnaissance, represented by the NYSE Advance Decline Line, also reported a pullback from previously secured high ground.

(Editor’s Note: Buff Dormeier is speaking at the Alternative Investing Virtual Expo, which runs Nov. 12-14, 2024. Click HERE to register)

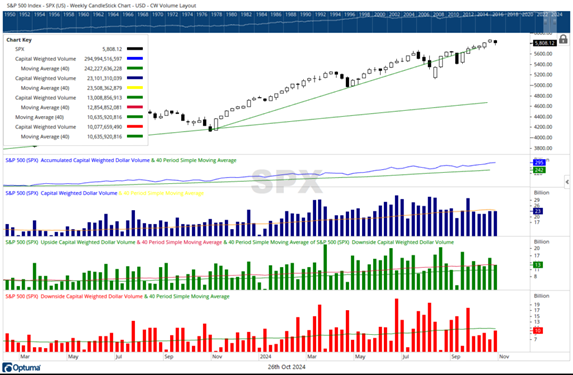

Despite this tactical retreat, our logistics corps, as measured by both Capital Weighted Volume and dollar volume, made minor advances, establishing new forward operating bases (new highs). While these supply indicators still trail behind the front lines (price), their recent momentum may bolster morale among our bullish divisions.