We live in interesting times. The price of gold is up more than the S&P 500 this year. Gold is rallying despite the rebound in the US dollar. Bond yields are currently rebounding and yet gold is still strong, too. So, what is going on? And how can Alamos Gold Inc. (AGI) help you profit? Here are my thoughts, explains Eoin Treacy, editor of Fuller Treacy Money.

My favored way of thinking about gold is as an asset that benefits from negative real rates. It has historically done best when real rates trend lower. That is not currently the case and gold is still powering ahead.

So, what is going on? Central bank buying is part of the answer. They bought around 600 tonnes a year between 2012 and 2019. The total dropped in 2020 for obvious reasons, but began to recover in 2021. Then purchases surpassed 1,000 tonnes in 2022 and again in 2023.

When the World Gold Council announced their half-year figures, the total buying was already 500 tonnes this year. So, it is reasonable to expect that central banks have continued buying.

Perhaps a better question is: Why are central banks buying gold? That answer is much more nuanced. There is a clear desire to reduce reliance on the US dollar system. That’s not so much about displacing the dollar as the medium of international exchange. Instead, there is a clear trend underway to ensure reserves are held in assets that are beyond the ability of the US government to influence. Non-US bonds and gold fit the bill as potential reserve assets.

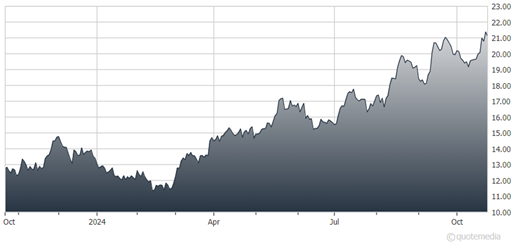

Alamos Gold Inc. (AGI)

As for AGI, it briefly hit a new high on Monday and rebounded on Tuesday. The trend remains quite consistent with a clear succession of higher reaction lows. I remain of the view that Alamos is a promising takeover candidate for a major looking to boost North American exposure.

Recommended Action: Buy AGI.