This country has a massive shortage of housing. It is estimated that the current demand for homes exceeds the national supply by a whopping 4.5 million. Toll Brothers Inc. (TOL) is the leading luxury homebuilder in the United States, and it should benefit, notes Tom Hutchinson, editor of Cabot Income Advisor.

The housing shortfall has caused the median US home price to double since 2011 and soar a staggering 40% just since the pandemic. In many areas, prices have increased a lot more.

As for TOL, the company operates in over 60 markets across 24 states and caters to move-up, active adult, and second-home buyers. Although the main business is home sales, Toll Brothers owns and operates several related businesses in architecture, engineering, mortgage, title, land development, landscaping, and lumber distribution.

Toll Brothers Inc. (TOL)

At first glance, the company may seem to miss the mark. There is a huge demand for first-time homes and new homebuyers. Toll Brothers isn’t in that market.

But it benefits greatly from the current housing shortage with more predictable and dependable affordable luxury buyers. It offers prestigious locations and distinctive architecture for a range of dwellings, including traditional homes, city apartments, and adult communities.

In this market, Toll Brothers and similar companies have been gaining market share like crazy from private companies. Publicly traded homebuilder companies now represent 53% of this country’s new home settlement, up from just 27% in 2012. Toll Brothers’ operational results have reflected the improving environment.

Since 2013, book value per share has grown at a compound annual growth rate (CAGR) of 13%, from $19.68 to $76.50. Return on equity has had a CAGR of 14% and earnings per share (EPS) have experienced 28% annual growth over the same period, from $0.97 to an estimated $14.50 to $14.74 for 2024.

But those things are in the rearview mirror. How do things look going forward? The industry dynamics have greatly improved in just the last few years. Demand will outstrip supply of new housing for many years to come.

And Toll Brothers has still barely made a dent in the potential. Toll Brothers is currently selling about 10,700 homes per year. But according to the company, the potential or addressable market for its type of homes is an estimated 575,000. That’s only 1.9% penetration.

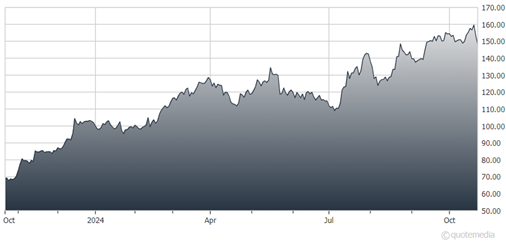

The stock has moved a lot higher over the last year as investors increasingly recognize the opportunity. But TOL has momentum.

Recommended Action: Buy TOL.