I get asked just about every day, and ahead of each election, whether we will alter our investment strategy depending on who wins the election. The answer is always “No.” Regardless of who wins, I believe the bond bear market will continue on – and long rates will move higher in fits and starts, observes Peter Boockvar, editor of The Boock Report.

I’ve learned over my 30 years in this business that investing based on your politics is never a good idea. Could there be outlier situations based on specific policies? Sure. But overall, we won’t change one thing. And I don't pay attention to the Wall Street sell-side lists that go around on which stocks to buy or sell depending on the outcome.

As for rates, they will matter for stocks. While stocks will initially react to whoever wins – with a perception that they rally further if Trump wins and don’t if Harris does – rates will mostly drive the equity bus if they continue higher from here.

We have a spending problem, not a tax problem. Tax revenues as a percentage of GDP are around 17%, the historic average. Spending is at about 23% of GDP versus the long-term average of around 20% or less.

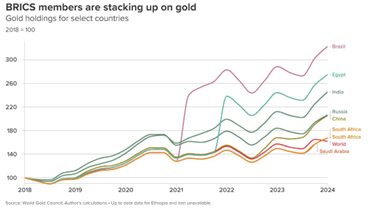

It’s hard to not think that US debts and deficits now matter when looking at the price of gold – and now silver, which is trading at an 11-year high (and which we remain bullish and long of).

With US Treasuries, I went through the August Treasury International Capital flow data and the biggest foreign buying is coming from hedge funds via the Cayman Islands and the UK as the Treasury basis trade continues to increase in size (buying cash Treasuries and shorting futures). The conventional central bank foreign buyer would now rather own gold (and hat tip to my friend Luke Gromen for pointing out this chart on Friday).