An important lesson I learned over the past few months is that only the best is good enough. Never buy a mediocre business just because you can buy it at a cheaper price than a pure quality company. One company that is a clear Compounding Machine? Visa Inc. (V), highlights Pieter Slegers, editor of Compounding Quality.

We only want to invest in the highest quality stocks available. Most investors know you should sell your losers as soon as possible and let your winners run as long as possible. You could also invert this statement. Look for companies that performed exceptionally well in the past.

With Visa, it was a clear market leader 20 years ago. It is a clear market leader today. And Visa will probably continue to be a market leader 20 years from now.

Together with Mastercard Inc. (MA), Visa dominates the entire payment industry. It’s also important to understand that the most important competitor for Visa isn’t Mastercard. It’s cash.

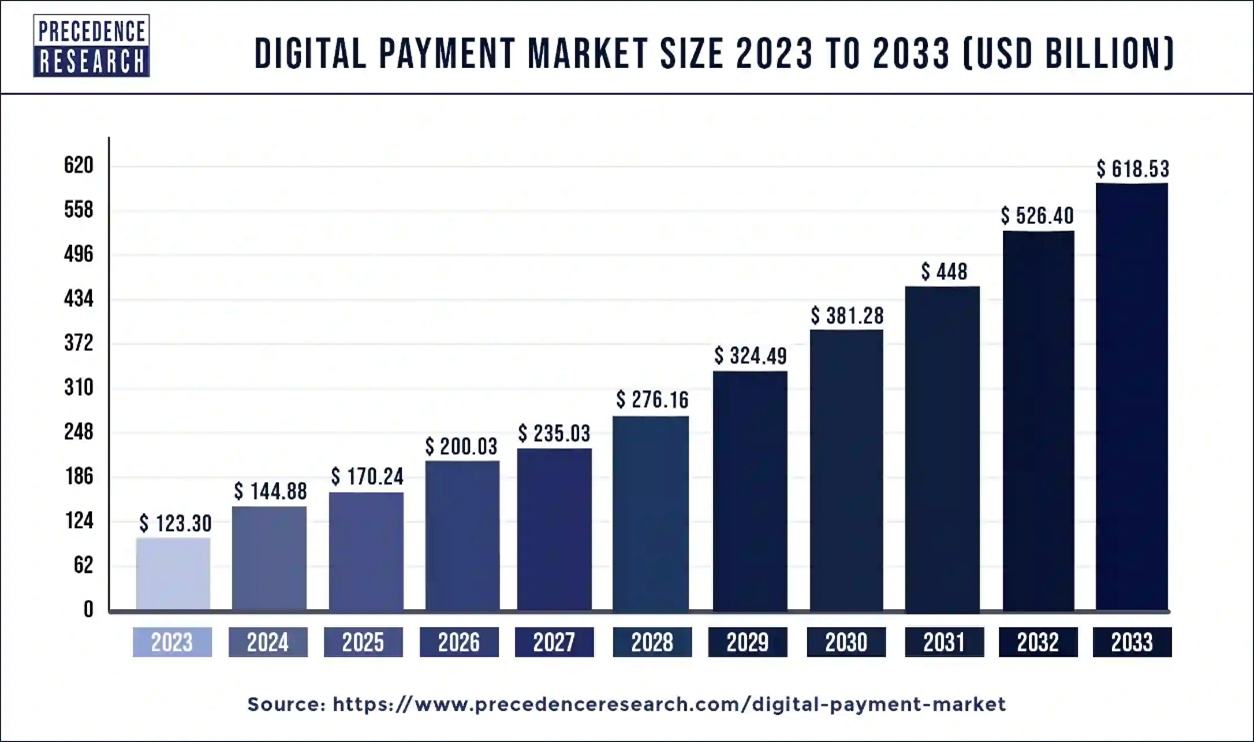

Visa benefits from the secular trends toward more and more digital payments. Until 2028, the total transaction value for digital payments is expected to grow by 9.5% per year.

Today, it has virtually become impossible to take away the market-leading position of Mastercard and Visa. Both companies process over 300 billion transactions (!) per year together.

You often hear that a new, promising FinTech company might disrupt Visa and Mastercard. In the end, they always end up working together with both companies. Why? They need V and MA to take their business to the next level.

Visa will be a cornerstone within our portfolio. It’s a “boring” company with very predictable cash flows.

Losers tend to keep on losing. Winners tend to keep on winning. Visa is a clear winner. It compounded at a CAGR of 20.5% per year since 2008.

And as Warren Buffett said: “The first rule of an investment is don't lose. And the second rule of an investment is don't forget the first rule.”

Recommended Action: Buy V.