Investors across the board are searching for the next big AI stock; however, it is noteworthy that most AI ventures are currently not profitable, and their path to profitability remains unclear, cautions Rida Morwa, editor of High Dividend Opportunities.

As income investors, it's wise to focus on sectors that are generating profits and cash flows, rather than those incurring heavy expenses. It is easy to spot where the cash flows from AI are — Artificial Intelligence is a power-hungry innovation.

So the cheaper way to invest in AI is not by seeking expensive and overvalued technology stocks, but by seeking those that power the technology itself. No matter which companies develop or use the best AI chips and software, they all need more power.

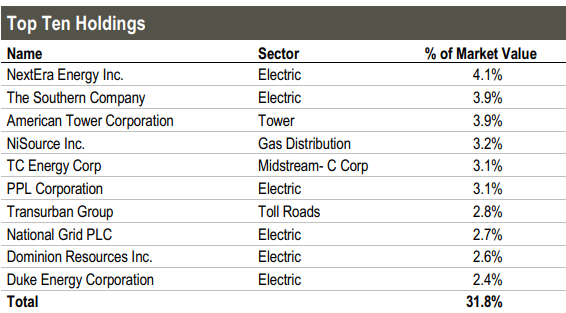

Cohen & Steers Infrastructure Fund (UTF) is a closed-end fund — or CEF — with a significant focus on electric utilities. Six of the CEF's top ten holdings are electric utilities, and they are among the largest in the United States.

UTF is actively managed with leverage to boost total returns to shareholders. The CEF reported a 30% leverage at a weighted average interest rate of 2.3%. 85% of the borrowing has rates fixed at 1.6% for a weighted average term of two years.

We expect the fund's leverage to be a strong tailwind amidst declining rates, supported by improved valuations for utility companies through AI deals.

Since its inception in 2004, UTF has maintained and grown its NAV while delivering consistent monthly distributions to shareholders. Its current $0.155/share monthly distribution calculates to a 7.4% annualized yield.