The third-quarter earnings season is getting off to a good start, with solid numbers coming from the big money center banks. Meanwhile, the glide path to a lower short-term benchmark interest rate is absolutely bullish for bonds as well as dividend growth stocks like Prudential Financial Inc. (PRU), advises Bryan Perry, editor of Dividend Investing Weekly.

As of earlier this month, the CME FedWatch Tool was forecasting a 90% probability of a quarter-point rate cut at the Nov. 7 Federal Open Market Committee (FOMC) meeting and an 84% chance of another quarter-point cut at the Dec. 18 meeting, which would have the federal funds rate ending the year at 4.25%-4.50%.

The main challenge for investors seeking high dividend yields is that dividend growth hasn’t kept up with the market. Dividend yields from blue-chip US companies have been trending downwards over time, evidenced by the Standard & Poor’s 500 Index dividend yield of approximately 1.78% at the end of 2022, lower yields throughout 2023, and recently only 1.21% for the S&P 500 ETF Trust (SPY).

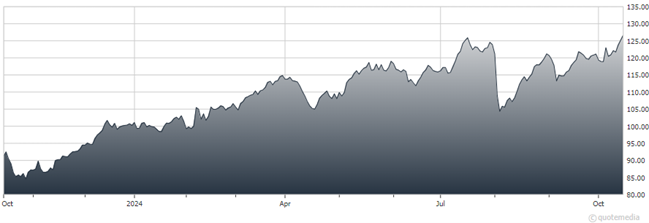

Prudential Financial Inc. (PRU)

This is well under the index’s long-run average yield of 2.91%. In fact, dividend yields have remained relatively low (below 3%) since 1992. The slowing of dividend growth over time is one more sign that small dividends remain the new normal.

Because of highly proactive monetary policy and the rise of technology stocks, today’s dividend investors have a bigger challenge to find great yields among great stocks. But they are out there, just not in big numbers.

Looking at the market’s 11 sector ETFs, the highest yielding are the Utilities Select Sector SPDR ETF (XLU), paying 2.79%, and the Consumer Staples Select Sector SPDR ETF (XLP), paying 2.58%. It seems clear that conventional ETF sector investing isn’t going to satisfy the need for qualified dividend yields.

This is where investors will have to exercise some due diligence to find those blue-chip and not-so-blue-chip stocks that pay dividend yields in excess of 4% to stay ahead of long-term inflation and the tax man. It’s the world investors live in, and it is only going to get more difficult. PRU is one stock I like, with a recent yield of 4.2%.

Recommended action: Buy PRU.