The bull market is now two years old and shows no signs of stopping. Since the bear market low in October 2022, the S&P 500 has risen more than 60%. One name I like is Cheniere Energy Partners LP (CQP), with a recent yield of 7.4%, writes Tom Hutchinson, editor of Cabot Income Advisor.

The move higher has been powered by the Artificial Intelligence catalyst, a surprisingly resilient economy, and the peaking of interest rates. Overall earnings are projected to be strong, and the market could get a further boost from AI-specific earnings this quarter.

Bull markets don’t usually peter out after two years unless some event changes the math. There are still two wars and the upcoming election. But unfavorable headlines are more likely to increase volatility rather than end the bull market. It should also help the market that the Fed has begun an easing cycle that should last a couple of years.

Cheniere Energy Partners LP (CQP)

Yes, the market is high and valuations are stretched. But high valuations can persist for long periods of time. And bull markets rarely end because of high valuations alone. It could mean that much of the good news is already priced into the market and returns will cool off for a while.

A flatter market is a good time for income. It bolsters the relative return of dividend stocks and covered calls can accentuate that advantage.

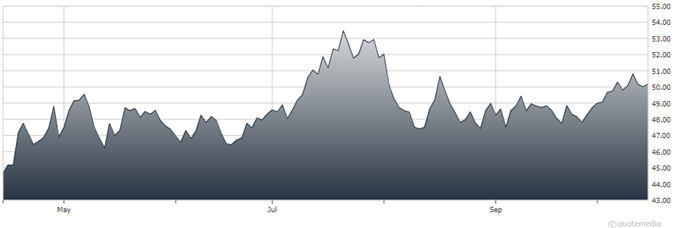

As for CQP, the stock had been weak since August because of a fall in natural gas prices. But it has been getting a bump higher in recent weeks because of the escalation of hostilities in the Middle East. Oil and gas prices are moving higher on the possibility of a large price spike because of a disruption in global supply.

CQP lives and dies somewhat in the near term on the fortune of energy prices. But the longer-term trajectory should be higher as the world will continue to demand US natural gas.

Recommended action: Buy CQP.