Warren Edward Buffett’s story isn’t quite a rags-to-riches tale. And his meteoric rise didn’t really begin until his investment firm purchased a struggling textile company Berkshire Hathaway…liquidated its core business…and made a major acquisition that took things in an entirely different direction – insurance. Let’s talk about it, and one of his targets, Chubb Ltd. (CB), says Nilus Mattive, editor at Weiss Ratings Daily.

Buffett’s target company was an insurer named National Indemnity. Here’s how he explained that purchase in his 2017 letter to shareholders:

“We began by purchasing National Indemnity and a smaller sister company for $8.6 million in early 1967. With our purchase, we received $6.7 million of tangible net worth that, by the nature of the insurance business, we were able to deploy in marketable securities. It was easy to rearrange the portfolio into securities we would otherwise have owned at Berkshire itself. In effect, we were ‘trading dollars’ for the net worth portion of the cost.”

The $1.9 million premium over net worth that Berkshire paid brought us an insurance business that usually delivered an underwriting profit. Even more important, the insurance operation carried with it $19.4 million of ‘float’ — money that belonged to others but was held by our two insurers. Ever since, float has been of great importance to Berkshire. When we invest these funds, all dividends, interest, and gains from their deployment belong to Berkshire.”

Essentially, Buffett recognized that insurance businesses typically had statistical advantages that led to regular profitability. Better yet, these businesses collected huge amounts of money upfront year in and year out — money that Buffett could use to make further investments in other businesses he’d like to own.

It’s a fundamental strategy that he continues to follow right up to the present. In fact, while Buffett has been taking more and more money out of the stock market as valuations get stretched, he has simultaneously been buying shares of yet another insurance company.

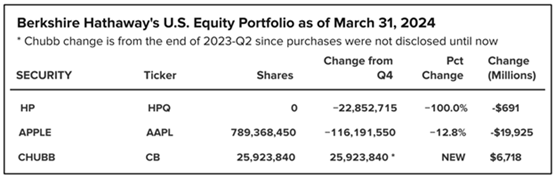

His target? Chubb. So far, Berkshire has spent roughly $6.7 billion buying more than 26 million shares of the company. He made these purchases around the same time Berkshire was selling 10 million shares of Apple Inc. (AAPL) and right after it dumped 80 million shares of HP Inc. (HPQ).

Trading richly valued tech stocks for a recession-resistant, cash-gushing business? Makes perfect sense to me!