The third-quarter earnings floodgates open this week, despite Monday being a partial holiday (with the bond markets closed). Wall Street will also be focused on retail sales data, looking for updates on consumer spending, writes John Eade, president of Argus Research.

The earnings calendar this week is packed with big companies from a range of sectors. On Wednesday, Morgan Stanley, US Bancorp, Discover Financial, and Abbott Labs weigh in. On Thursday, it’s Netflix and Travelers, and on Friday, American Express and Procter & Gamble step up to the plate.

Earnings grew 13% in the second quarter. We expect Q3 earnings growth of 5%-7%. For the full year, we forecast roughly a 7%-9% gain. In Q3, we expect information technology, communication services, and healthcare to be the sectors that shine.

On the economic calendar, retail sales will be updated on Thursday, as will industrial production and capacity utilization. On Friday, housing starts and building permits will be released. Argus Chief Economist Chris Graja is highlighting retail sales as the call of the week. Chris expects the September report to show an annual increase of 2.2%.

He adds that “the report will be a timely health check on consumers ahead of the important holiday season. Employed consumers do their best to make the holidays special for the people they care about. The decline in the September unemployment rate to 4.1% should be a positive catalyst for shopping in November and December.”

Last week, there were mixed signals on inflation. CPI slowed to 2.4% for September, down from 2.5% in August. Core CPI ticked up to 3.3% in September from 3.2% in August. Looking deeper into the core inflation data, the widely watched shelter component is still proving to be sticky, with a rise of 4.9%.

The Bureau of Labor Statistics said that this one component accounts for more than 65% of the total 12-month increase. Other categories with sizable increases include motor vehicle insurance, up 16%, and medical care, up 3.3%.

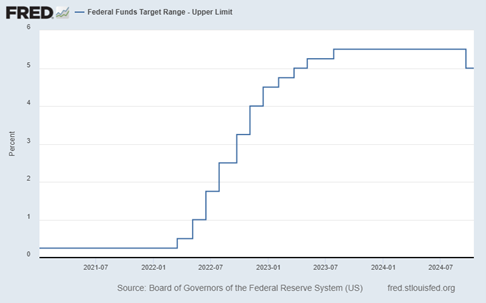

The next Fed rate decisions are on Nov. 7 and Dec. 18. For November, odds are at 90% that there will be a 25 basis-point (bp) rate cut, according to the CME FedWatch tool. There had been chatter about a bigger cut, but recent strong jobs data squelched that idea. Argus forecasts two more rate cuts by the end of 2024 and three more in 2025, all by 25 bps.