Asset management giant BlackRock Inc. (BLK) earned $11.46 per share in Q3 versus $10.91 a year ago, and ahead of the $10.40 estimated by the Street. Revenue was up 15% from the same period a year ago. Net inflows totaled $221 billion (the highest in a quarter ever) and total assets under management stood near $11.5 trillion, notes John Buckingham, editor of The Prudent Speculator.

CFO Martin Small said: “Our capital management strategy remains, first, to invest in our business, to either scale strategic growth initiatives or drive operational efficiency; and then to return excess cash to shareholders through a combination of dividends and share repurchases. At times, we may make inorganic investments where we see an opportunity to accelerate growth and support our strategic initiatives.”

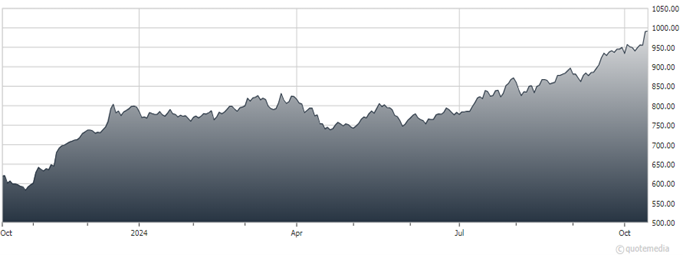

BlackRock Inc. (BLK)

CEO Laurence D. Fink added: “Growth of private markets is underpinned by the continued rise of infrastructure. It presents a generational investment opportunity. Over the next 15 years, the world will need to invest $75 trillion to repair aging infrastructure to invest in new projects like data centers and decarbonization technology. The current cash flow inflation-protected return profile of infrastructure makes it an attractive sector for our clients. Most of them will represent investor savings for retirement.”

Blackrock repurchased $375 million of stock in the third quarter and expects to buy back the same amount in the fourth quarter. We thought BLK turned in a great quarter, propelled by market movements and strong execution.

We continue to like that BlackRock’s diversified investment and technology platform has demonstrated an all-weather track record of generating positive organic growth across good and bad times. Shares gained 3% last Friday in conjunction with other strong earnings reports. Our Target Price has been hiked to $1,039.

Recommended Action: Buy BLK.