There are a number of insurers that look attractively priced today, and that are poised to deliver strong total annual returns over the next five years. One favorite is American Financial Group Inc. (AFG), writes Bob Ciura, contributing editor at Sure Dividend.

The insurance industry has created many great fortunes. That’s because it is slow-changing and highly profitable, if the business is done well. Investing in insurance stocks is how Shelby Davis made $900 million from $50,000 starting in his late 30s.

AFG is an insurance holding company that is engaged in property and casualty insurance, focusing on specialized commercial products for businesses. In 2021, the company completed the sale of its annuity business for $3.8 billion in cash.

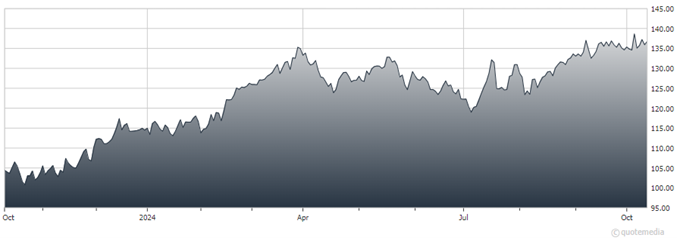

American Financial Group Inc. (AFG)

AFG reported Q2 2024 earnings on Aug. 6. For the quarter, earnings per share came in at $2.49, above the $2.34 per share that the company reported for the same period in 2023. During the quarter, the company paid 71 cents per share in regular dividends.

Annualized core operating return on equity was 18.5% for the second quarter, with increased investment income resulting from strong underwriting margins and higher interest rates. The company’s book value per share stands at $52.25, and the company’s growth of book value plus dividends during the quarter stood at 4.7%.

Recommended Action: Buy AFG.