Now that the Fed has officially launched its rate cutting cycle, it’s time to give the broader fixed income space another look. The PIMCO Income Strategy Fund II (PFN) invests in a diversified mix of government and corporate, investment-grade and non-investment-grade, fixed-rate and floating-rate notes from around the world, writes Michael Gayed, editor of The Lead-Lag Report.

(Editor’s Note: I’m pleased to welcome Michael Gayed to the roster of experts whose work I digest for your benefit. Mike is also speaking at the 2024 MoneyShow Orlando, which runs Oct. 17-19. Click HERE to register)

A lot of investors have felt satisfied leaving their cash parked in a 5% yielding T-bill or money market account without any risk. Since the Fed already cut by 50 basis points and has many more cuts in its plans, those previously juicy yields are going to start shrinking quickly.

PFN employs a multi-sector approach seeking high current income consistent with the preservation of capital. It invests in a diversified portfolio of floating and/or fixed-rate debt instruments. The fund has the flexibility to allocate assets in varying proportions among floating- and fixed-rate debt instruments, as well as among investment grade and non-investment grade securities.

The fund’s duration will normally be in a low to intermediate range (zero to eight years). PIMCO also considers capital appreciation and principal preservation through intensive fundamental, macroeconomic, industry, and company-specific research. The fund also utilizes leverage in order to enhance yield and total return potential.

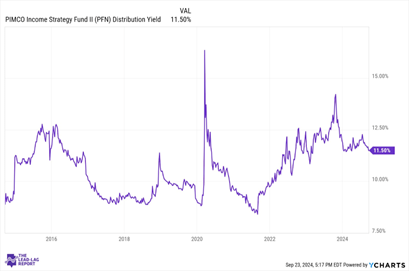

PFN maintains a fixed monthly distribution policy that currently pays $0.0718 per share, or $0.8616 per share annually. At its recent share price, that translates to a forward-looking yield of 11.4%.

The “go anywhere” approach of this fund might be its biggest draw. Its mix of securities across the credit quality spectrum from all around the world give it a diversification that you find in few other fixed income CEFs. Since many funds in this group focus deep into the low-quality end of the pool, a fund that maintains a roughly 60/40 split between investment-grade and junk bonds holds particular appeal.

There are some risks. In general, I’m not sure how heavy investors want to get into low-grade credit at the moment. Plus, high yields and bear markets tend to run a higher risk of widening discounts and distribution cuts. But overall, this looks like a nice high yield option worth considering

Recommended Action: Buy PFN.