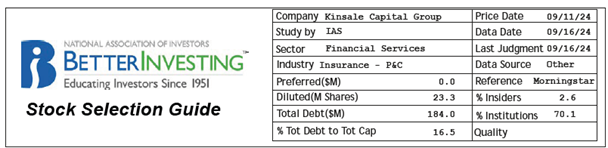

While the S&P 500 remains near all-time highs, markets have been choppy as sentiment has vacillated between belief in the Federal Reserve’s ability to achieve a soft landing and concerns regarding a more significant slowdown. Meanwhile, I like the insurance company Kinsale Capital Group Inc. (KNSL) here, says Doug Gerlach, editor of Investor Advisory Service.

Progress on inflation set the table for the Fed’s half-point rate cut at its September meeting, as Chair Powell had noted that the balance of risks to the Fed’s two mandates, price stability and stable employment, have changed. Inflation has come down, trending toward the Fed’s 2% target, while the labor market has slowed.

As for Kinsale, it operates exclusively as an excess and surplus (E&S) lines insurer, primarily in the commercial market. “Excess and surplus lines” refers to specialized policies created to address unique risks. It is also frequently referred to as the “nonadmitted” market because E&S carriers are not required to file their forms and rates with each state, only their home state.

In other words, they aren’t “admitted” as carriers in each state but instead are free to operate nationally. Most large admitted commercial carriers also offer E&S lines, including E&S market leader Berkshire Hathaway, American International Group, and Chubb.

According to S&P Global Market Intelligence, the E&S industry has grown more than twice as fast as the total property and casualty market in recent years, comprising 9.2% of the market in 2023 compared to 5.2% in 2018. Rising catastrophe losses and litigation risk have reduced the risk appetite of traditional carriers, leaving the E&S market as the only place to cover certain risks.

Kinsale was the 22nd largest writer of E&S insurance in 2022, the most recent year for which comparisons are available. It was also the second-fastest grower among the 25 industry leaders. The company estimates it holds just 1.6% of the E&S market.

Kinsale primarily writes “long-tail” business in which it may take years to determine its ultimate liability. Over 90% of its policy reserves represent estimates of future claims (known as “incurred but not reported," or IBNR). Long-tail risks allow the company to earn returns on the money over an extended period.

Despite that opportunity, the duration of its bond portfolio is just three years. About 92% of its portfolio consists of cash and bonds, with equities comprising the remaining 8%. The average S&P rating of its bond holdings is AA-.

Based on robust growth in the E&S market, Kinsale’s modest market share, and its high returns on capital, we believe the company can grow earnings by 20% annually. Five years of such growth could lead to EPS of $26.64 if we project off its trendline.

Applying its average high P/E ratio of 36.5, the stock could more than double to a price of 972. Adding in a small dividend, the potential total annual return approaches 17%. The risk of the lofty P/E assumption is significantly offset by understating its growth potential compared to projecting off the recent observation.

We project the downside risk as 28% to 325, its 52-week low and the low price implied by the multiple of its last 12 months earnings of $15.90 and the low P/E of 20.5.

Recommended Action: Buy KNSL.