The long awaited and overdue half-point cut in the federal funds rate was the impetus for the SPDR Biotech ETF (XBI) to finally break above the 102-103 level after three or four attempts. Meanwhile, Bicycle Therapeutics Plc (BCYC) had a strong ESMO following promising new data for BT8009, BT5528, and BT7480, explains John McCamant, editor of The Medical Technology Stock Letter.

Rising interest rates hurt biotechs – and vice versa – so now it’s time to put the risk on as biotech discount rates fall in line with interest rates. It will be interesting to see if the potential of even-lower rates leads to some M&A activity that has been absent for a while.

The RSI of the XBI is around 63. Hence we are nowhere near overbought levels yet. Technically, the moving averages keep moving steady ahead – from 96-97 to 98-99 (50-day) and 90-91 to 92-93 (200-day). Overall, we will watch to see that the index can stay above the 101-102 resistance in place since July.

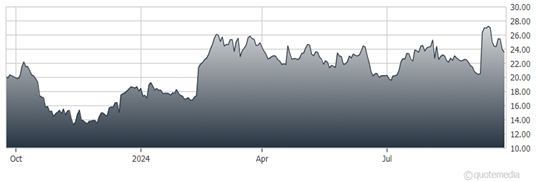

Bicycle Therapeutics Plc (BCYC)

As for BCYC, we see the updated data as encouraging, supporting a differentiated profile of BCYC‘s programs and providing additional validation to the platform. Dr. Charles Swanton, who is on BCYC‘s Scientific Advisory Board and Clinical Advisory Board, believes that BCYC’s platforms have significant potential in other indications beyond bladder cancer (particularly in NSCLC).

We anticipate additional updates for ‘8009 in other tumor types and combination data with pembro in 1L mUC later this year or Q1 25. In our view, ‘8009 is well on its way to being best in class with a better tox profile than Padcef.

Recommended Action: Buy BCYC.