A yield curve inversion does not in itself cause a recession. However, it reflects the kinds of conditions that lead to recessions, which is why it is so widely followed. But several factors have mitigated recessionary concerns on this occasion, advises Eoin Treacy, editor of Fuller Treacy Money.

The banking sector is less likely to lend when they are looking at a negative margin on loans. That withholds resources from the economy and tightens credit.

But in this cycle, private lenders have stepped in to provide liquidity. That has provided a lifeline for the private sector, which is under reported because it does not pop up in official statistics. That also helps to highlight where the bulk of financial risk is concentrated.

For now, earnings are still at record highs, and that is insulating private debt from a downturn. The Fed cutting interest rates has the capacity to keep the party going for a while longer by extending the earnings growth cycle, too.

The second factor is that the US federal government is spending money with abandon. That is creating a future problem for the economy, but for now, it is sustaining economic growth. I am reminded of the boom in the UK between 2004 and 2008 when the Labour Party engaged in profligate spending. It didn’t end until an exogenous shock hit the economy.

The third is that a great deal of debt was refinanced in 2020/21, so there is no imminent refunding cliff. That is sitting out in the 2026+ timeline, but is not currently relevant.

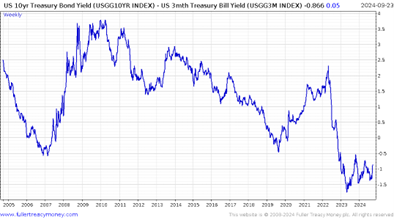

The fourth is that a great deal of cash is sitting on the sidelines, which is helping to compress yields. The 10-year/2-year curve indicator might be trending higher into positive territory, but the 10-year/3-month is still deeply inverted. It is reasonable to expect that real signs of trouble will not appear until the latter measure is also trending higher into positive territory.

Lastly, the S&P 500 broke out to new all-time highs over the last week – and has so far held the gain. That move has been assisted by the weakness of the US dollar.