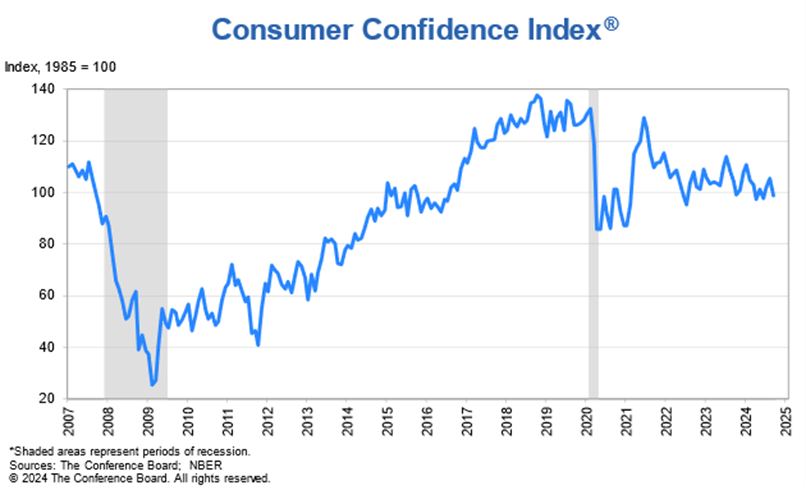

The September Conference Board Consumer Confidence index disappointed with a print of 98.7, down from 105.6 in August and below the estimate of 104. That’s the third weakest figure going back to July 2022, highlights Peter Boockvar, editor of The Boock Report.

The Present Situation index led the drop as it fell by 10.3 points month-over-month to 124.3. That was the lowest level since March 2021, and something not seen since 2016 pre-Covid. The Expectations component fell by 4.6 points, but it’s holding well above its lows. One-year inflation expectations ticked up to 5.2% from 5%.

The deterioration in the Present Situation was driven by further weakness in the answers to labor market questions. Those that said jobs were plentiful fell to the lowest since March 2021. A “jobs hard to get” reading rose to the highest since February 2021.

On the Expectations side, the reading for those expecting “more jobs” in the coming six months was little changed, though it did rise. That was offset though by a pick up in those expecting “fewer jobs,” with the balance seeing no change. Expectations softened for income growth.

With respect to spending intentions, they were little changed for vehicles but did lift for homes, likely helped by the drop in mortgage rates. They fell for most categories of major household items though.

In terms of demographics, consumer confidence for the key category of 35-54 year olds declined to a level last seen at the depths of the Covid lockdowns – and back to 2014 before then. Income-wise, those who make under $50,000 are stressed with confidence declines across that cohort. They were at the highest since January for those who make over $125,000.

Bottom line: Weakness in the labor market was the main reason for the confidence decline. It follows, of course, the Fed cutting by 50 basis points instead of 25 bps.