In early September, the Bank of Canada lowered its benchmark interest rate by 25 basis points to 4.25%, the third consecutive drop since June. As the central bank pursues a more-accommodative stance with interest rates, we believe that select Canadian companies offer investment opportunities. One is Canadian Pacific Kansas City Ltd. (CP), advises John Eade, president of Argus Research.

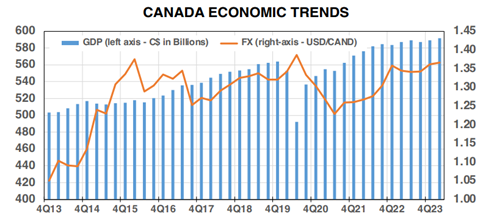

The central bank noted overall weakness in the economy and progress on inflation. Canadian unemployment rose to 6.6% in August from 6.4% the month before, with population growth outpacing jobs growth. Meanwhile, GDP growth averaged only about 2% in the first and second quarters of 2024, and the Canadian economy added a modest 22,000 jobs in August, down from a much higher 90,000 in April. Consumer price inflation eased to 2.5% in July, closer to the central bank’s 2% target.

Similar to the US, shelter inflation in Canada remains elevated, though lower interest rates have started to help as mortgages renew at better levels and rent increases ease. The governor of the Bank of Canada remarked as follows: “With inflation getting closer to the target, we need to increasingly guard against the risk that the economy is too weak and inflation falls too much.”

CP operates a transcontinental railway in Canada and in the Northeast and Midwest US. The company is among the most-efficient operators in the rail industry, which has been on more of a secular growth trend than other transport options (such as water, pipelines, and trucks) for the past 20 years.

Having emerged victorious in a bidding war for Kansas City Southern Railway, management now can focus on earnings and dividend growth. Recent results have been solid, given economic conditions.

Freight revenue per ton-mile (volume) rose 6% in 2Q, led by greater shipments of Potash, and 2024 guidance calls for double-digit adjusted EPS growth versus 2023. On valuation, CP is trading at 21 times our 2025 EPS estimate, near the high end of the five-year historical range of 14-24 and above the North American peer average of 19.

We think this is a reasonable valuation, given the company’s long-term record of industry outperformance. Our 12-month target price is $87.

Recommended Action: Buy CP.