FactSet Research Systems Inc. (FDS) reported fiscal fourth quarter revenues increased 5% to $562.2 million, with net income jumping 37% to $89.5 million and EPS up 38% to $2.32. Annual Subscription Value (ASV) increased 4.7% to $2.28 billion, highlights Ingrid Hendershot, editor of Hendershot Investments.

Operating margin increased 100 basis points to 22.7%, mainly due to a decrease in employee compensation costs, growth in revenues, and lapping of the prior year's facilities impairment charge, partially offset by a $54 million charge related to a Massachusetts sales tax dispute.

During the quarter, FactSet generated $137.2 million in free cash flow, down 12.2% from last year’s fourth quarter. That was primarily due to lower net cash provided by operating activities and a jump in capital expenditures to support generative AI offerings.

FactSet Research Systems Inc. (FDS)

For the full year, revenue increased 5.6% to $2.2 billion, representing the 44th consecutive year of revenue growth, with net income and EPS increasing 15% to $537.1 million and $13.91, respectively. During the fiscal year ended Aug. 31, FactSet generated a stellar 28% return on shareholders’ equity and $614.7 million in free cash flow, representing an impressive 114% of reported net earnings.

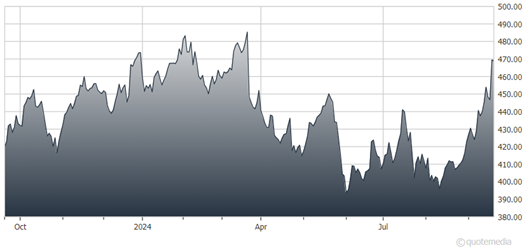

FactSet returned $385.9 million to shareholders during fiscal 2024 through dividend payments of $150.7 million and share repurchases of $235.2 million at an average cost per share of $437.40. That included $63 million repurchased during the fourth quarter at an average cost per share of $412.09.

FactSet increased its dividend by 6% during the third quarter, marking the 25th year of consecutive dividend increases. FactSet ended the fiscal year with $492.6 million in cash and investments, $1.2 billion in long-term debt, and $2.1 billion in shareholders’ equity on its strong balance sheet.

Looking ahead to fiscal 2025, FDS expects revenues in the range of $2.285 billion and $2.31 billion, up 4.2% from fiscal 2024 at the midpoint, with EPS in the range of $15.10 to $15.70, up 10.7% from last year at the midpoint. Management expects the second half of the fiscal year to be stronger than the first half.

Recommended Action: Buy FDS.