Eversource Energy (ES) is a utility headquartered in Boston. It provides electricity, natural gas, and water services to over 4 million customers in Connecticut, Massachusetts, and New Hampshire. In total, we project that Eversource will provide a total annual return of 16.9% through 2029, notes Ben Reynolds, editor of Sure Dividend.

The company is actively involved in renewable energy projects, like offshore wind, and has set ambitious goals for reducing greenhouse gas emissions and supporting clean energy initiatives in the region. Eversource Energy is a $24 billion company and has about 10,200 employees.

On July 31, Eversource Energy posted its second-quarter results for the period ending June 30. The Electric Transmission segment saw earnings rise to $189 million, driven by higher investments in the transmission system. The Electric Distribution segment's earnings dropped to $149.7 million due to higher storm restoration costs and increased operational expenses, despite higher revenues from rate increases and infrastructure investments.

The Natural Gas Distribution segment's earnings improved to $27.1 million, up from $11.7 million last year, thanks to higher revenues from investments in natural gas infrastructure and a base distribution rate increase.

The company reported earnings of $335.3 million, a significant increase from $15.4 million in the same quarter last year, which had been affected by an impairment charge. Earnings per share came in at $0.95, up from $0.04 the previous year. Eversource expects FY2024 EPS between $4.50 and $4.67.

As a utility, Eversource Energy can recover some of its investment in its infrastructure in the form of rate base increases. This was seen in the company’s most recent quarterly report. Eversource Energy is also investing in renewable energy sources as it aims to compete in this area of power generation.

Eversource has consistently grown its EPS over the years, with an average growth rate of 6% over the past decade. We expect this trend to continue, supported by rate hikes, transmission investments, and clean energy. Some uncertainty around transmission rates persists, nonetheless.

Shares of the company recently traded with a price-to-earnings ratio (P/E) of 14.6. Our target multiple is 21 times earnings, which suggests that shares are undervalued. If Eversource achieves this target valuation by 2029, it could add a substantial 7.6% to the annual returns over this period.

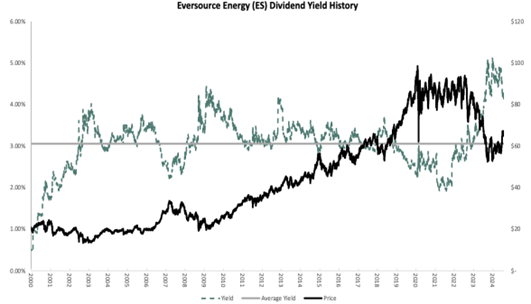

In total, we project that Eversource will provide a total annual return of 16.9% through 2029. This stems from earnings growth of 6%, the starting dividend yield of 4.3%, and a high single-digit tailwind from a potential multiple expansion.

Recommended Action: Buy ES.