There’s a secret that both lazy and wise men tap to build wealth. Its power has been hailed by geniuses and harnessed by novices. And it’s something every person reading this should fawn - not yawn - over. I’m talking about compounding – and McDonald’s Corp. (MCD) is a great case study, observes Matthew Carr, editor of Tipping Point Profits.

It’s no coincidence that some of the most successful and wealthiest investors of all time have spent their careers hyper-focused on dividends and exploiting the power of compounding. Their faces are carved on the Mount Rushmore of investing: John Templeton…Benjamin Graham…Warren Buffett.

Because time combined with interest – or dividends – can transform a small sum into a vast fortune. That’s the perfect recipe for success for those investors who want to do as little work as possible, while at the same time be able to embrace every downturn as a victory.

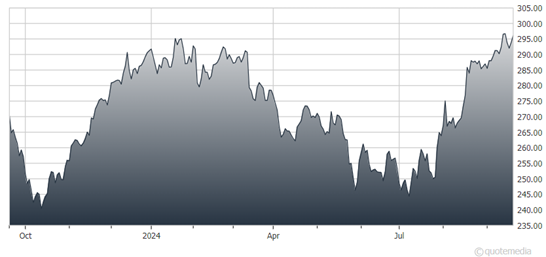

McDonald's Corp. (MCD)

For example, let’s consider MCD. Everyone knows McDonald’s. And practically everyone on the planet has eaten there.

McDonald’s has been paying a dividend since 1976 – longer than I’ve been on this particular planet. The current payout is $6.68 per year per share for a yield of 2.27%. And it’s considered a member of the Dividend Aristocrats – an elite group of 68 stocks that have paid and raised their dividend for at least 25 years.

This offers an unparalleled opportunity on Wall Street. Time – and compounding – create wealth and excitement.

For instance, let’s say on Jan. 1, 2008, we invested $10,000 in McDonald’s. At a price of $59.83, we buy 167 shares. Well, today, those shares would be worth $48,919.31. That’s simple share price appreciation. A gain of 389% over 17 years. Not too shabby.

Plus, we amassed a total of $10,809.10 in dividend payments. And we’re currently receiving $278.89 per quarter in dividends ($1.67 x 167 shares).

But watch what happens when we tap the power of compounding. We’re going to do that with a dividend reinvestment program (DRIP). This takes all the dividends we’re paid each quarter and automatically reinvests them, buying more shares…which means more dividends…which means more shares…etc.

Using a DRIP, that same $10,000 invested in McDonald’s on Jan. 1, 2008, would be worth 78,334.11 today. That’s a gain of 683.3%! And we no longer own 167 shares. The number has grown to 267.4 thanks to the DRIP. That means, each quarter we’re receiving $444.05 in dividends, which is being transformed into 1.7 new shares…which leads to more dividends.

And what was the fancy, secret trading strategy you employed? Nothing. You did absolutely nothing except turn on that DRIP. You didn’t worry about selloffs or corrections. You didn’t worry about bear markets or recessions.

Better yet, every time shares dipped, your dividend yield increased, and your DRIP went further. This is why I preach dividend stocks must be the foundation of every portfolio. Because dividend stocks coupled with time and compounding are unmatched in terms of success.

Recommended Action: Buy MCD.