I’m looking for potential opportunities in early-stage candidates due to the additional improvement in the market’s intermediate-term outlook, thanks to the Fed’s latest rate cut. One position, Zillow Group Inc. (Z), was one of last week’s biggest movers, notes Clif Droke, editor of Cabot Turnaround Letter.

We further continue our focus on rate-sensitive stocks for a falling interest rate environment, with a focus on underappreciated real estate equities. Several stocks in the portfolio have benefited from recent company developments or news headlines.

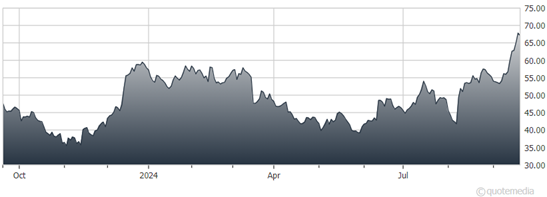

Zillow Group Inc. (Z)

Zillow was up 24% from last week. This occurred despite US existing home sales recently hitting a 30-year low. Home sales are expected to average only around four million annualized units for the rest of 2024, slightly below last year’s sales pace.

Home inventories remain tight, however, and there’s still plenty of pent-up demand as prospective buyers are likely waiting for mortgage rates to fall further before pouncing. Moreover, Zillow is doing a fine job of improving the monetization of its online traffic, boosting revenue growth even in the face of a weak housing market.

Zillow has the most customers of any real estate site, with a roughly 70% market share. The company is also three times the size of any of its competitors and has a sizable opportunity to further expand the reach of its apps. I recently recommended selling a quarter of our long position in the stock, but I’m maintaining a Hold rating for the remaining three-quarters of the position we have left.

Recommended Action: Hold Z.