US stocks soared to new all-time highs in a broad-based global rally late last week. Investors and traders have seemingly adopted an optimistic view of the Fed kicking off its easing cycle with a 50-basis point bang. Meanwhile, PayPal Holdings Inc. (PYPL) announced a deal with Amazon.com Inc. (AMZN) amid a turnaround push, writes Tom Bruni, head of market research at The Daily Rip by Stocktwits.

Defensive stocks lagged on Thursday’s big rally day, with tech and other cyclical sectors shining. Eight of 11 sectors closed green, with technology (+2.95%) leading and utilities (-0.61%) lagging.

(Editor’s Note: Tom Bruni is speaking at the 2024 MoneyShow Orlando, which runs Oct. 17-19. Click HERE to register)

As for PYPL, investors clowned a bit on the payments giant for its logo and branding refresh. It took a “modern and simplistic” approach that we’ve seen many US brands embrace in recent years. However, the stock popped to its highest level since April 2023 as more investors begin to buy in to the company’s turnaround story.

Adding to the momentum was news that Amazon has added PayPal as a payment option to “Buy with Prime,” an area of Amazon’s business that is growing rapidly. Bears say this is a niche business offering that won’t move the needle for PayPal. But bulls say this integration is evidence that the new management team is focused on the right things and building clear momentum in the marketplace for the PayPal brand.

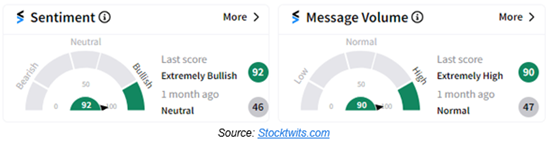

The Stocktwits Community is siding with the bulls on this one, with sentiment pushing into “extremely bullish” territory from the “neutral” zone it was stuck in for much of the last month.