I just put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed institutional managers with $593 billion in assets under management. Here are the key investor takeaways, writes Tom Hayes, editor of HedgeFundTips.

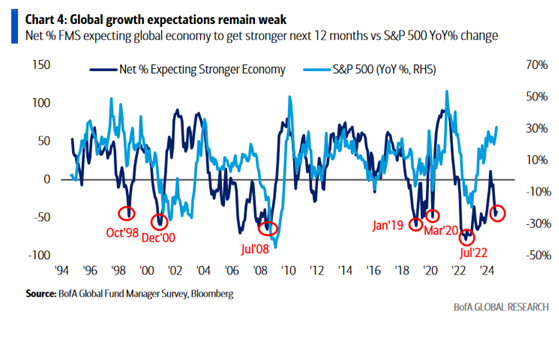

1. As well as markets have done, managers are still skeptical. That implies (after some normal seasonal volatility) markets can climb the “wall of worry” to new highs after the election.

(Editor’s Note: Tom Hayes is speaking at the 2024 MoneyShow Masters Symposium Sarasota, which runs Dec. 5-7. Click HERE to register)

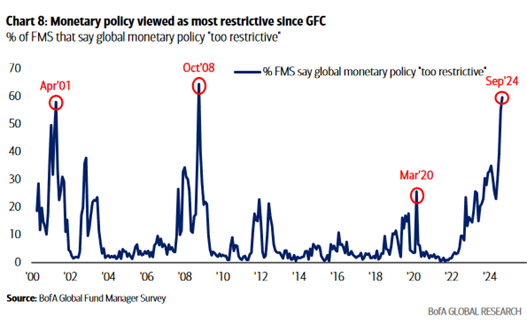

2. Managers believe that policy is too restrictive...but results resemble prior periods that were near generational “Buy” areas, not tops to be “Sold.”

3. Managers are too crowded into defensives, setting the stage for cyclicals to do well over the next year.

4. Opportunity is setting up in commodities with managers at a seven-year low for exposure.

5. “Long China equities” is setting up as best contrarian trade (currently one of most crowded shorts).