Most of the Federal Reserve’s past monetary easing cycles were triggered by financial crises that quickly morphed into economy-wide credit crunches, which caused recessions. In our opinion, lowering the federal funds rate too much, too fast now could trigger an economic boom, in which real GDP grows at a brisk pace but with higher inflation risks, observes Ed Yardeni, editor of Yardeni QuickTakes.

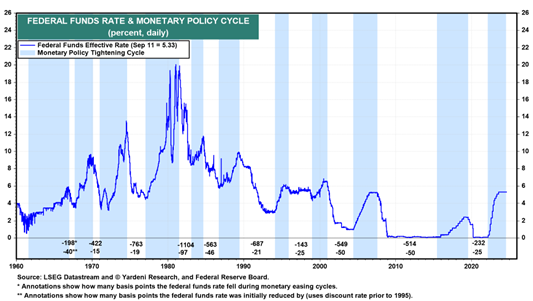

Since 1960, the Fed reduced the funds rate by more than 500 basis points during the average easing cycle. So, it's no wonder that the futures market is increasingly expecting a 50-bp cut today, followed by another 200 bps of cuts over the next 12 months.

However, most previous easing cycles started from much higher rate levels. Additionally, the Fed only cut the funds rate by 25 bps three times during the 1995 easing cycle, the most recent soft landing.

One risk in this cycle is that aggressive cuts could trigger a 1990s style melt up in the stock market. Let's review the latest economic backdrop that the Fed is cutting rates into:

(1) Regional manufacturing. The New York Fed's regional M-PMI increased for the first time in nearly a year this month, rising from -4.7 to 11.5. New orders and shipments improved substantially, and the forward-looking outlook improved across indicators.

(2) Consumer spending. The New York Fed's quarterly household spending survey was just released. It showed nominal household spending increased from 4.6% year-over-year in April to 5% in August. The increase in spending was broad-based across education levels and income groups. Consider that the CPI inflation rate fell from 3.4% YOY in April to 2.6% in August. So in real terms, spending rose from 1.2% YOY to 2.4%.