Paul Tudor Jones, one of the most successful money managers of all time, once said: "I attribute a lot of my success to Elliot Wave Theory. It allows one to create incredibly favorable risk reward opportunities." Here’s what Elliott Wave analysis suggests about silver’s next move, writes Avi Gilburt, founder of ElliottWaveTrader.

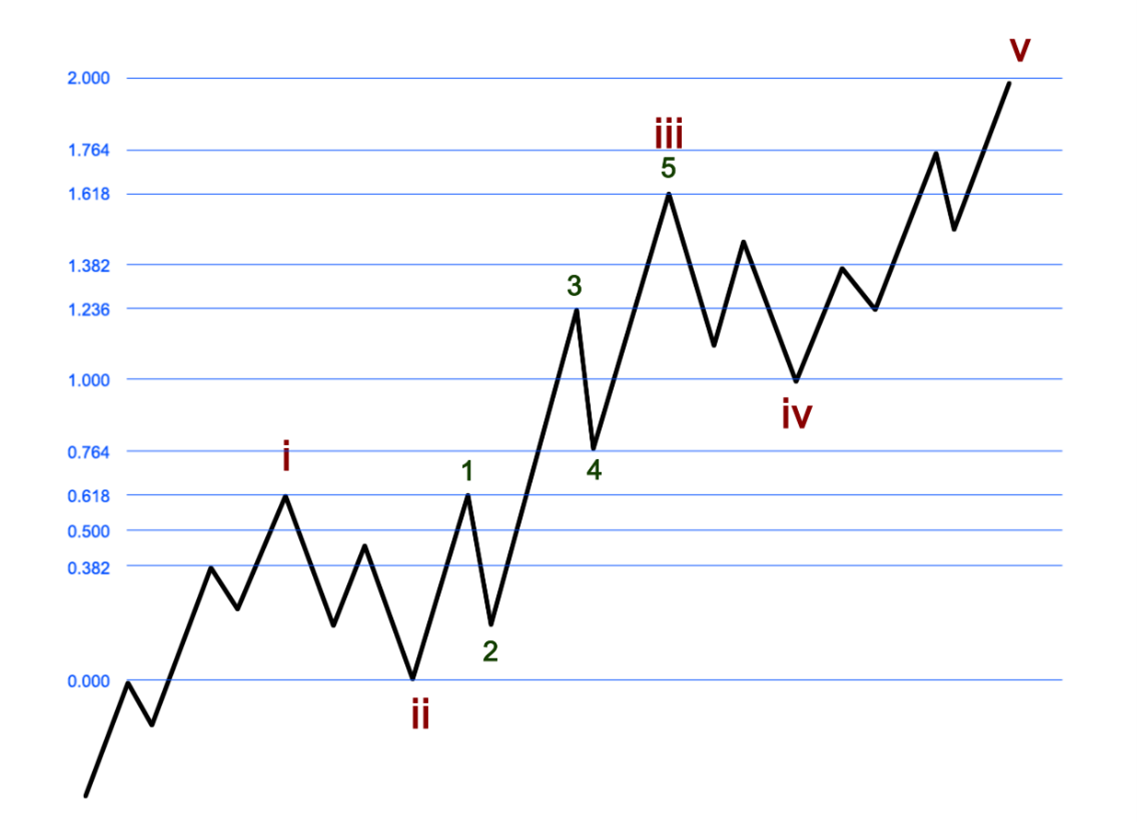

Back in the 1930s, an accountant named Ralph Nelson Elliott identified that markets represent unconscious, non-rational reactions which follow a repeating fractal pattern. Most specifically, Elliott theorized that public sentiment and mass psychology move in five waves within a primary trend, and three waves within a counter-trend.

Once a 5-wave move in public sentiment has completed, then it is time for the subconscious sentiment of the public to shift in the opposite direction, which is simply the natural cycle within the human psyche, and not the operative effect of some form of “news.”

Also, take note that waves 1, 3, and 5 move in the direction of the general trend, and waves 2 and 4 are counter-trend moves. Also note that waves 1, 3, and 5 further break down into five-wave structures – which I show as an example within the third wave - whereas the corrective, counter-trend moves of waves 2 and 4 break down into three-wave structures.

Now, I want you to take note that the segment one would want to trade is the heart of a third wave, as they are the strongest segments of a rally in equities. And, while third waves are still very strong in metals, their fifth waves are even stronger.

So, as an investor, you want to be layering into a market as a third wave is about to begin. If you look at the chart above, the set up you are seeking is a i-ii, 1-2 structure, wherein you can move into the market during the wave 2 pullback, so you are prepared for the wave 3 of iii.

Silver is now developing a structure within its wave 2. The only question I have is if silver has begun its third wave, or if there is one more drop to complete its wave 2 before the heart of the third wave begins in earnest.

I will not bore you with the mathematical details as to how I calculated the resistance, but $31.73 is coming up as a very strong point for me over the coming week. Unless silver is able to blow through that resistance, we have a set up in place that can take silver down quite strongly over the coming weeks towards the $23.75-$26.72 region to complete its second wave.

Of course, if silver can blow through the $31.73 region and continue through $33.35, then we are on our way to our next target in the $37.25-$40 region, and also on our way to much higher targets after another smaller pullback from that higher target region.

So, I would be watching your positions in silver over the coming week or two, as one more decline can still take shape before we are ready for the major break out.