Housing is very sensitive to interest rates, as you might imagine. So, it makes a lot of sense to add a home builder like M/I Homes Inc. (MHO) as rates are set to head lower, advises Steve Reitmeister, editor of Zen Investor.

There were a lot of industry peers I could have selected instead. However, it is the impressiveness of their earnings momentum the past two years, when rates went higher, to help me appreciate how well the organization is run.

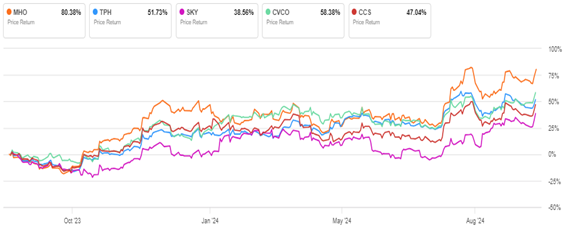

This translated to industry leading share price gains for MHO (orange line) – nearly 2X that of their peers, which shows up loud and clear in the performance chart below.

The issue with price action is that it’s a statement of the past. Looking forward, MHO is expected to earn $20.76 in earnings per share in 2025. That is up more than 15% since its last quarterly earnings report. Note that the company only beat by 11%...so it says that analysts see even more good times ahead for it.

Right now, the top analyst covering the firm is Buck Horne from Raymond James (Top 9%) who sees $210 as the rightful destination for shares. That does sound nice from current levels...but only equates to 10X next year’s earnings. That says to me upside is even more impressive, making it very attractive to build a position in shares right now below $170.

One of my favorite things about MHO is that it is underfollowed by Wall Street. Yet, with such impressive earnings momentum, and fundamentals in the top 5% of all stocks measured by the POWR Ratings...I suspect more analysts will initiate coverage of MHO with “Buy” ratings.

That fresh analyst coverage will most certainly be a catalyst for shares to break above $200...and keep running. Plain and simple, with interest rates set to drop, there are few stocks more attractive than MHO.

Recommended Action: Buy MHO.