Hacker scum try to steal our information all the time. Heck, every employer I know is working hard to stop hackers. That’s because cybercrime is booming – and that is tremendously bullish for select ETFs and companies. One example would be the Amplify Cybersecurity ETF (HACK), notes Sean Brodrick, editor at Weiss Ratings Daily.

Fighting cyber-attacks will cost companies worldwide an estimated $10.5 trillion annually by 2025, up from $3 trillion in 2015. That’s why I’m very bullish on the cybersecurity market. The growth of cybersecurity depends on who you ask, but a commonly cited forecast is a CAGR of 14.3% from 2024 to 2032.

(Editor’s Note: Sean Brodrick is speaking at the 2024 MoneyShow Orlando, which runs Oct. 17-19. Click HERE to register)

HACK holds a basket of leading cybersecurity stocks. It has a Weiss Rating of “C,” a dividend yield of 0.18%, and an expense ratio of 0.60%.

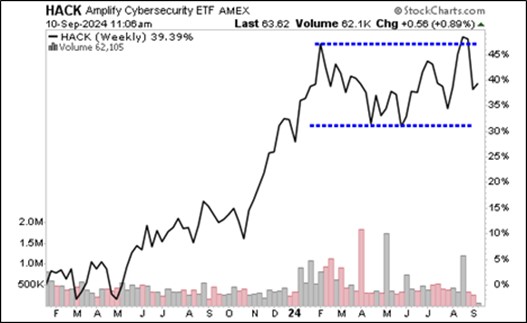

You can see the fund ripped higher last year. And it has spent this year consolidating sideways. With cybercrime on the rise, more money is going to pour into the companies in HACK. I think it should break out soon, and my six-month target is 35% higher.

Recommended Action: Buy HACK.