The historic discontent between the price of oil and the supply and demand fundamentals is either signaling that the global economy is going into a deep recession, or if you’re an optimist, an easing of inflation that will create an open runway for a soft landing for the economy and our friends at the Fed. Here is my take, says Phil Flynn, senior energy analyst at The PRICE Futures Group.

While you know that I am an optimist, the problem we have is that the market is trading like we have a massive oversupply and crashing demand. Yet the truth is that we are in a world where demand is exceeding supply, despite concerns about demand from the Chinese economy and Europe. In fact, if you consider the latest snapshot of US oil supply from the American Petroleum Institute (API), you might be worried not about a price crash, but an oil shortfall.

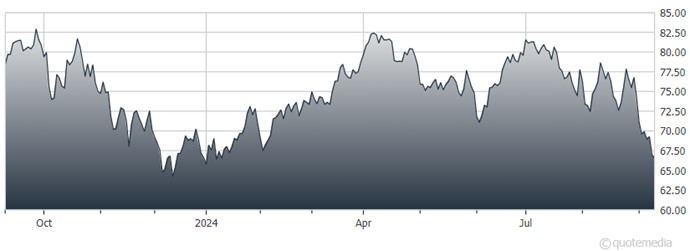

United States Oil Fund (USO)

Even as oil trades near a three-year low in price, and refiners reportedly are paying a premium over futures for crude, one must ask why the futures are the most disconnected from the physical market maybe ever. And it’s not just supply and demand that the market seems to be ignoring. It also seems to be ignoring the risks to supply. We still have ongoing outages and Libya that continue to draw down on the global sweet well supply. Hurricane Francine also shut in some production.

The disconnect between oil futures prices and the tight supplies of oil could turn out to be a very dangerous combination. If the market stays well supplied, the drop in oil prices is welcome as it will be a boom for the economy. On the flip side, if artificially low prices cause a shortage, we could see a price spike that could cause a shock to the economy and drive us into a recession.

In the meantime, it is the hedge fund flows that will drive us. If the hedge funds run for cover at the same time, then watch out. If not, enjoy the ride or the financial crisis or whatever this historic disconnect is going to tell us.

Finally, the Energy Information Administration (EIA), while still predicting a supply deficit, thinks everything is going to be hunky dory as demand growth slows. The agency said US consumption should hold steady at 20.3 million barrels a day in its latest monthly report. That was a shift from the last month, when the EIA forecast demand would grow by 1% year-over-year.

Nevertheless, global consumption is seen growing by 1 million barrels a day. That would put the market in supply deficit this year due to decreased output from OPEC and its allies.