We haven’t had a good start to September. Investors came back from the summer in a foul mood, and last Friday’s lousy jobs report exasperated the angst. Meanwhile, I was losing my patience with Alexandria Real Estate Equities Inc. (ARE), but I’m encouraged by its recent behavior, observes Tom Hutchinson, editor of Cabot Dividend Investor.

The August jobs report showed only 142,000 jobs created, which was below expectations. Of course, almost all of the jobs reports this year have been adjusted lower in subsequent months. So, this is probably much worse than 142,000.

Fears still seem somewhat overblown. And the market did recover on Monday. The selloff is at least partly caused by September. Investors tend to focus on risks this time of year. If fears don’t materialize, stocks should recover.

Alexandria Real Estate Equities Inc. (ARE)

Plus, a pullback is healthy as the market was getting high. It’s also worth noting that falling interest rates will be good for several of the interest rate-sensitive and defensive stocks in the portfolio. Time will tell whether last week was a repeat of early April and early August, when the market bounced right back, or something more.

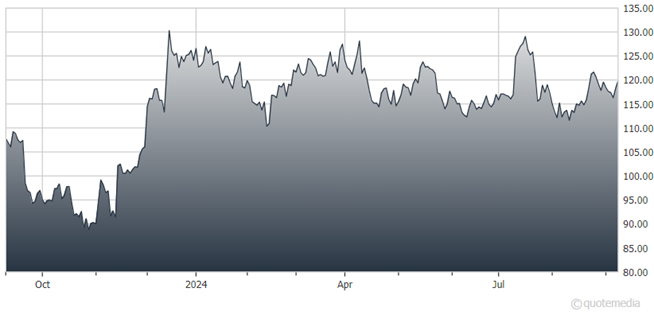

As for ARE, this niche innovation center property REIT hit a 52-week low in mid-August. But it had a strong move higher over the rest of the month. It has moved down in the past couple of weeks along with most other stocks, yet the uptrend is likely to last as long as interest rates trend lower. The defensive characteristics may serve ARE well going forward with increased recession fears.

Recommended Action: Buy ARE.