When it comes to investing, there are two critical “bedrocks” we need to keep in mind. Everything else builds out from there. These two facts are why 95% of my favorite high-income investments, closed-end funds (CEFs), have made investors money over the last decade. Those include the 8.4%-yielding Adams Diversified Equity Fund (ADX), writes Michael Foster, editor of CEF Insider.

The two bedrocks are: 1) Diversification cuts your risk of loss. The more diversification, the lower your risk. And 2) In the long term, stocks and bonds make money, regardless of short-term volatility.

ADX’s portfolio of large cap stocks includes Microsoft Corp. (MSFT), Visa Inc. (V), JPMorgan Chase & Co. (JPM) and Eli Lilly & Co. (LLY). Stock picks like these have helped ADX post a stellar 296% total return, on a market-price basis, in the last decade.

When it comes to buying CEFs for the long term, a diversified fund is usually the better way to go. But we do need to talk about one other thing here: Size. It’s a key piece of the CEF story because CEFs tend to be smaller than their popular ETF cousins. As a result, they tend to be overlooked — and a great place to go hunting for bargains.

Frankly, it’s too bad most people miss out on CEFs, because not only have 95% of them made money in the last decade, but there are plenty that beat comparable ETFs. Consider ADX’s best ETF benchmark, the S&P 500-tracking S&P 500 ETF Trust (SPY), a common holding in many portfolios.

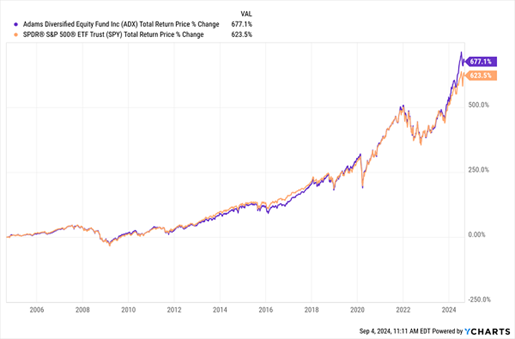

ADX (in purple below) has clearly outrun it in the last decade. And due to the massive difference in these funds’ yields (1.2% for SPY, around 8.4% for ADX), much of ADX’s return in that time was in dividend cash.

ADX Beats the Market, With Most of Its Return in Cash

Even so, many people miss out on ADX because of the popularity of SPY and the fact that the ETF is much larger: SPY has $551 billion in assets, 190 times more than ADX!

So, what’s causing big ETFs to attract more money than the better-performing alternatives? The secret is in the name: The “C” in “CEF” stands for closed, meaning these funds cannot issue new shares to new investors and get bigger.

ETFs can. So, even if a CEF is doing well, it can’t issue new shares to new investors. The only way to get in is to buy shares from another investor. Fortunately, CEFs are publicly traded, so they’re readily available to retail investors looking for superior returns and higher yields.

“But if CEFs are so great,” you might be asking, “why don’t more people invest in them?” Honestly, I don’t have a good answer for that. But I can tell you the small minority of people who do invest in them have used them to obtain financial independence. I left my academic career in my 30s thanks to CEFs and started writing on them for fun. I’m still having fun writing about them today.

Recommended Action: Buy ADX.