After Covid there was no sector that did better than Consumer Discretionary. Locking everyone down and sending them all a check to go spend, as it turns out, was great for the sector. Then 2021 ended and the correction in consumer began. Years in the making, here is something that has people talking, notes JC Parets, founder of AllStarCharts.

Is this a massive top in the Consumer Discretionary Select Sector SPDR (XLY) relative to the S&P 500 ETF Trust (SPY)? Or is it that the consumer stocks are just finding support once again where they did a decade ago? Is the squeeze now ready to get going? It's interesting that chip stocks find themselves in a very similar position.

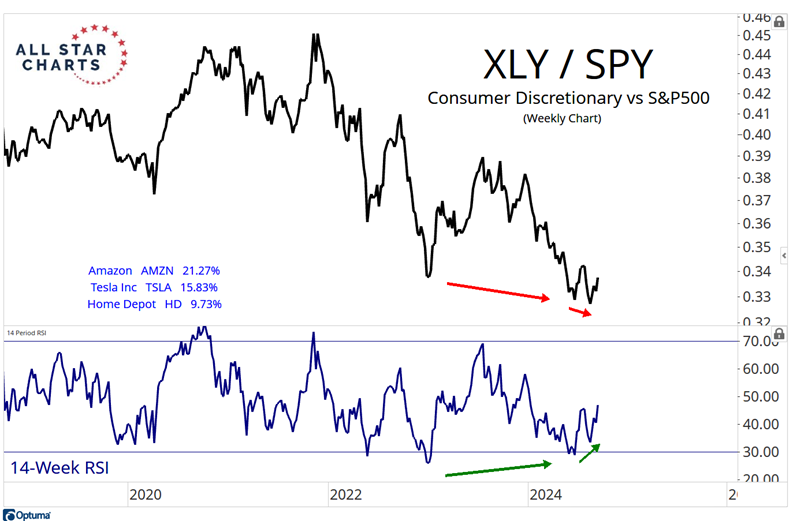

And don't lose sight of what's happening in XLY right now. With lower lows in the relative price chart, you're seeing a series of higher lows in momentum. Here's the weekly chart showing exactly that from a longer-term perspective:

And it's not just the longer-term. You're seeing it on multiple timeframes.

If this is a massive top in discretionary that's going to bring down the whole market, you're going to see it in its largest components: Amazon.com Inc. (AMZN), Tesla Inc. (TSLA), and Home Depot Inc. (HD), which combined represent almost half the entire sector index.

But is a massive top in the consumer the bet you want to make in the middle of a bull market? Or is this not the middle and the bull market is already over? Which are you betting on?

Personally, I'm not convinced that these are tops. I'm not convinced that the bull market is over. I'm not convinced that these are all about to collapse.

The reason is because we've yet to see any evidence that would suggest this is going to happen. Where is the expansion in stocks making new lows? Why do they keep digging in and buying them up when they need to?

Call me when we actually see breakdowns. Call me when we see these "massive tops" actually being completed. Then we'll act accordingly. But we haven't seen it yet.