There is an asymmetric opportunity available – relatively low risk for a relatively large reward. It’s relatively low risk since it’s cheap because Wall Street hates it and it’s a lower-risk legal structure. It’s a relatively large reward because – well – Wall Street is wrong. I’m talking about funds like the iShares US Real Estate ETF (IYR), counsels Michael Murphy, editor of New World Investor.

Wall Street thinks commercial real estate is falling apart. Recently, investors in the AAA tranche of $308 million of debt backed by 1740 Broadway in midtown Manhattan received only 74% of their money. Creditors in the five lower tranches were totally wiped out.

Numerous Wall Street trader/salesmen had to call their clients and say: “Hey, remember that BB+ tranche on 1740 Broadway that I got you when you needed yield? Ummm…you need to reprice it. To zero. Sorry.”

So, of course Wall Street hates commercial real estate. The market for office buildings, already on the ropes from higher vacancy rates due to the rise in remote-work policies, has been crushed by high borrowing costs. Roughly $930 billion in commercial real estate loans will also come due this year, according to the Mortgage Bankers Association.

Many of those loans will have to be refinanced at a substantially higher interest rate than they carry now. Yet net rental income can’t cover the interest payments. One reason: Operating expenses for all types of buildings have gone up dramatically in the last few years, particularly insurance premiums. Plus, the value of the buildings has fallen below the face value of the debt. The lenders, including many regional banks, are shafted.

For office buildings, yes, the day of reckoning is here. But guess what? Most commercial real estate is not office buildings, yet all commercial real estate stocks have been dragged down by Wall Street’s abandonment of the sector.

Hospitals and assisted living centers are not vacant – far from it, with the aging population. Self-storage centers are full. We have a shortage of multifamily apartment buildings. Many non-office REITs are cheap (market capitalization/funds from operations), down sharply from their highs, and pay a decent growing dividend.

I’m not going to veer any further off course. But if you are interested, you might take a look at some of the larger REITs. Or just buy an ETF like IYR.

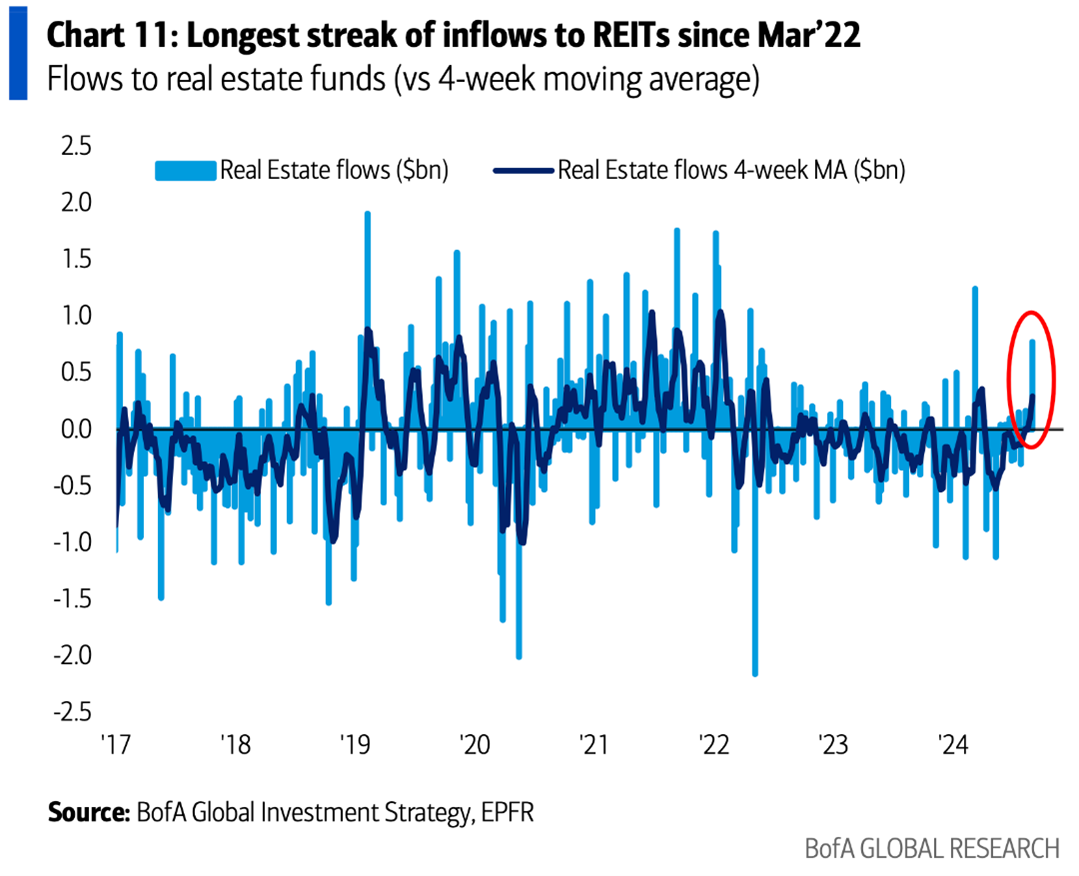

By the way, we are not catching a falling knife here. REITs just saw five consecutive weeks of inflows, the longest streak since March 2022. That included $800 million in a recent week, the most in five months.

Recommended Action: Buy IYR.