I’m particularly happy with a new addition to my Flying Five Portfolio, International Business Machines Corp. (IBM). It is our best-performing stock in the past two months, propelled by its leadership in Artificial Intelligence (AI) research, highlights Mark Skousen, editor of Forecasts & Strategies.

AI goes back a long way with IBM. The company gained notoriety when its Big Blue supercomputer beat world champion Garry Kasparov in a chess match in 1997. IBM remains an AI leader today with its Watson AI engine and mainframe servers. It also designs its own AI accelerator chips, complementing its use of Nvidia Corp. (NVDA) processors.

(Editor’s Note: Mark Skousen is speaking at the 2024 MoneyShow Orlando, which runs Oct. 17-19. Click HERE to register)

IBM also helps clients avoid pitfalls such as AI hallucinations, copyright infringement, and low-quality data sources.

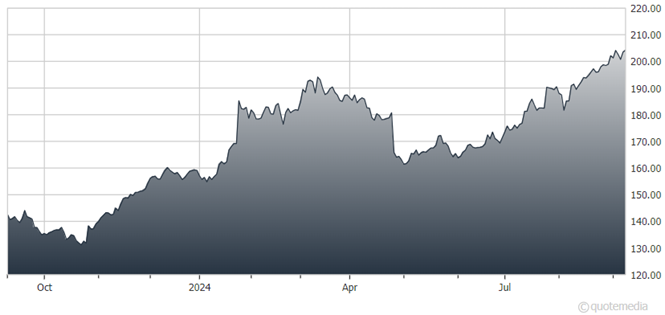

International Business Machines Corp. (IBM)

Finally, it is an innovator in the next generation of quantum computing space. Arvind Krishna, who has been CEO since 2020, states, “Leadership is not a birthright. It takes perpetual reinvention. It requires working tirelessly to innovate. It demands a willingness to question tired traditions. And it implies making big, bold decisions to be on the right path.”

I have a long history with IBM. Their executives contacted me in the early 1980s after reading my Bantam paperback, “High Finance on a Low Budget.” It offered easy ways to start investing with as little as $100. I did a nationwide tour with the book and sold a quarter of million copies. (The highlight was appearing on the news show “LA Today” with host Regis Philbin.)

IBM was having problems with their employees depending too much on IBM’s generous medical, retirement, and other benefit programs. They asked me to create a personal finance course to help thousands of IBM employees to save, invest, and become more financially independent.

After several months of hard work, my team and I came up with a CD Rom. IBM executives were pleased with our training program but insisted that we make it clear in the first slide that IBM has a policy of permanent employment. Once an IBM employee, always an IBM employee.

Years later, I realized that’s what IBM’s problem was. There was little or no incentive to work hard and be creative. Employees were too dependent on IBM’s generous welfare program. Ten years later, IBM hired an outsider, Lou Gerstner Jr., as CEO, who immediately downsized the company and laid off thousands of workers.

It was only then that IBM returned to its glory years -- by incentivizing its employees. Gerstner proved that “Elephants Can Dance,” the title of his memoir.

It took a while, but today, a new dynamic Big Blue is making waves, and we are profiting. It is facing stiff competition from Amazon Web Services and Microsoft Azure, but the outlook for IBM as an AI leader is positive.

Recommended Action: Buy IBM.