The details of every utility recovery story throughout history have been different. But ultimately, they all had one thing in common: The best (and really, only) option for regulators when these companies stumbled was essentially tough love – fixing the problem but leaving the utility franchise intact. Dominion Energy Inc. (D) is one utility that’s on the recovery road, highlights Roger Conrad, editor of Conrad’s Utility Investor.

Shareholders suffered initially in past cases. But at the end of the day, companies’ financial health was always restored, and critical investment in affected utilities’ growth resumed. That’s the single most important factor to keep in mind when considering the ongoing electricity and natural gas utility recovery stories in the Utility Report Card universe.

(Editor’s Note: Roger Conrad is speaking at the 2024 MoneyShow Orlando, which runs Oct. 17-19. Click HERE to register)

With Dominion, I don’t expect dividend increases until the company reduces debt sufficiently. And the company will have to bring the 2.6-gigawatt Coastal Virginia Offshore Wind (CVOW) facility into service as well.

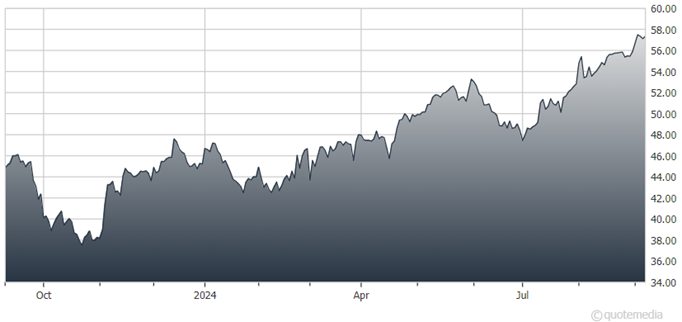

Dominion Energy Inc. (D)

So far, CVOW construction is running on time and at an all-in cost below the maximum amount recoverable, as stipulated by Virginia regulators. And Dominion has won leases at a very low price ($17.7 million) for additional acreage adjacent to CVOW that the Bureau of Ocean Energy Management says could generate another 2.5 to 4 GW of offshore wind energy.

If the company can close the sale of its North Carolina natural gas utility to Enbridge Inc. (ENB) and the ownership stake in CVOW to Stonepeak in Q4, it will essentially have met debt reduction targets. And securing a 20-year license extension for the North Anna nuclear plant is a big plus for meeting robust demand growth for electricity from America’s largest concentration of data centers.

If Dominion can bring CVOW into service on schedule in 2026 without significant cost inflation, I think earnings growth will accelerate and dividend growth resume in short order. In the meantime, risk to the current payout continues to drop and relations with regulators improve.

Recommended Action: Buy D.