Delivery is lightning fast, information is abundant, and instant gratification is just a phone swipe away. But lately, a lot of us have been happy to wait when it comes to big decisions, paralyzed by over a year of high rates. Friends, we’re stuck in the “great wait” economy. Pull up a chair and get comfy, because we might be here for a while, writes Callie Cox, chief market strategist at Ritholtz Wealth Management.

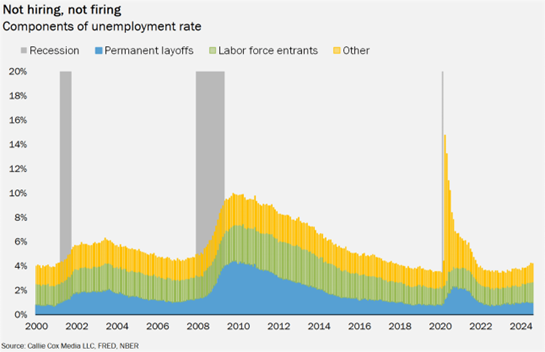

Take the latest jobs report, which showed that companies are adding jobs at the slowest pace since 2020. Still, layoffs were low in August, comprising just 1% of the workforce. Businesses aren’t hiring many people, but they aren’t firing many people, either.

Companies are finding ways to do more with the workforce they have instead of expanding it. Productivity – or the measure of worker output per hour – grew at a 2.7% year-over-year rate last quarter, more than double the average productivity growth we saw in the 2010s.

The Fed – that group of nerdy academics in charge of rates – is pulling the right levers. Mechanically, lower rates should entice people to spend, and prompt businesses to hire and invest. But that hasn’t happened yet.

How low do rates need to go to pull America out of the great wait? Fed members think it’s about two percentage points lower than where we are now. Three percentage points of cuts would get us to the point where the current Fed funds rate is in line with price growth, as measured by personal consumption expenditures data.

There are academic formulas like the Taylor Rule that suggest how to calculate the ideal rate for the economy based on expected inflation and economic output gaps. But at this stage, any calculation – no matter how thoughtful or precise – is just an educated guess. The economy is way too dynamic to be pinned down by a single magic rate.

We might be stuck in a vicious cycle, though. If enough of us delay big financial moves in hopes of lower rates down the road, we may never make it out of this rut. Redfin has noted that homebuyers are waiting to see how low mortgage rates will drop after the Fed starts cutting. It’s hard to say when, or if, enough people will be satisfied.

For what it’s worth, Wall Street seems sick of waiting. They’ve skipped straight to the recession, punishing every economic report that looks somewhat ominous. While I don’t fully agree with that interpretation, it may be a sign of things to come in the stock market.

It’s difficult to definitively say we’re in a recession. But it’s equally hard to claim we’re in a good place. So, for now, we wait while preparing for the worst and hoping for the best. Don’t give up on the stock market. This is when resilience and planning matters most.