We first introduced manufactured housing innovator Cavco Industries Inc. (CVCO) in 2019. With impending reductions in interest rates on the horizon and ever-growing demand for housing across the US, we think this is an opportune moment to review this well-managed builder of manufactured and modular homes, notes Doug Gerlach, editor of Small Cap Informer.

The post-Covid buying frenzy in housing faded as soaring prices and mortgage rates froze sales. Limited inventory further stifled options. Now, as housing supplies grow and the Fed eyes rate cuts, dreams of homeownership are rekindling. Buyers are eagerly awaiting renewed affordability and choice in their quest for homes, and housing-related stocks are poised for a comeback.

Cavco Industries Inc. (CVCO)

Cavco is a leading designer and maker of “systems-built structures” including manufactured homes, modular homes, commercial buildings, park model RVs, and vacation cabins. The company operates 31 homebuilding production lines and is the third largest builder of manufactured homes in the US after Berkshire Hathaway-owned Clayton Homes and Skyline Champion.

As of May, Cavco’s market share in the US was just over 13%, up from 12% in 2021. Cavco distributes homes through a large network of independent distribution locations in 48 states and Canada and 79 company-owned US retail stores, of which 47 are located in Texas.

Cavco reported a 0.4% increase in revenues in its first fiscal quarter ended June 29, reaching $478 million compared to $476 in Q1 last year. Though the topline growth was slight, it represented the seventh consecutive quarter of increased plant orders. It was also up 20% compared to Q4, a good indicator of the scale of the uptrend expected to carry through the next few quarters at least.

Sequentially, the average selling price dropped 4% as fewer sales were made by company-owned stores and more sales were made of single-section units. These variables of product mix and sales originations tend to shift from quarter-to-quarter.

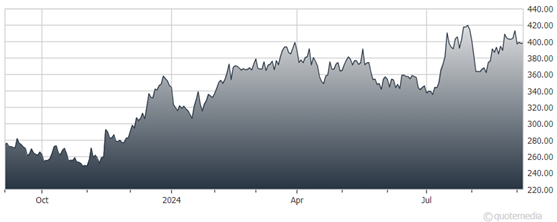

With an estimated future high P/E of 28, reflecting a return to pre-pandemic valuation levels, and future expected EPS of $34.53, a forecast high price of $967 results. On the downside, if the stock falls to a P/E of 14, and EPS stall at the FTM level of $18.46, a low price of $240 is indicated.

From the recent price of $404.29, an upside/downside ratio of 3.4-to-1 results, with a potential annual return of 19%.

Recommended Action: Buy CVCO.