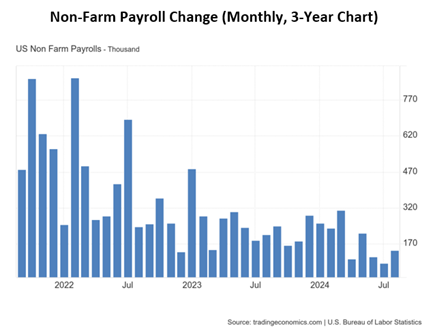

While it will likely be revised many more times, the first stab at the August payroll establishment survey saw a job gain of 142,000, 23K below expectations. The two prior months were also revised down by a total of 86K. Bottom line: The slowdown in the pace of hiring is unmistakable, writes Peter Boockvar, editor of The Boock Report.

The private sector added 118K, not far from what ADP said. The household survey said a net 168K jobs were created, which exceeded the 120K-person increase in the labor force. That’s why the unemployment rate ticked down by one tenth to 4.2% as the consensus estimated.

(Editor’s Note: Peter Boockvar is speaking at the 2024 MoneyShow Toronto, which runs Sept. 13-14. Click HERE to register)

Hours worked held at 34.3 as forecasted, up from 34.2 last month (which could have been influenced by Hurricane Beryl). The participation rate was unchanged at 62.7%...and still below where it was in February 2020 at 63.3%, in part due to retiring Boomers.

Health/social assistance and the leisure/hospitality sectors drove almost the entire increase in private sector hiring, contributing 90K of the 118K. Similar to what ADP said, the information sector shed 7K. Also, retail lost 11K jobs. Temp jobs continue to be lost, too, down by 3K. Financial added 11K.

On the goods side, manufacturing saw a drop of 24K as a two-year recession in this sector is now leading to a pickup in firings. Construction, on the other hand, added 34K with government spending/tax and grant incentives helping here. Government hiring totaled 24K, with 23K of it coming from state and local governments.

The 3-month average headline job gain (and thus including government) is now 116K. That compares to the 6-month average of 164K and the 12-month average of 196K. The full-year 2023 average job gain was 251K.

As for Federal Reserve rate cut odds in September, it’s a coin toss. At the end of last week, there was a 100% chance of 25 bps and a 56% chance of 50 bps. If I were to guess what they would do right now, I’d say 25 bps, though I’m sure some will push for 50 bps. We can very well end up with that if this week’s inflation data further moderates.